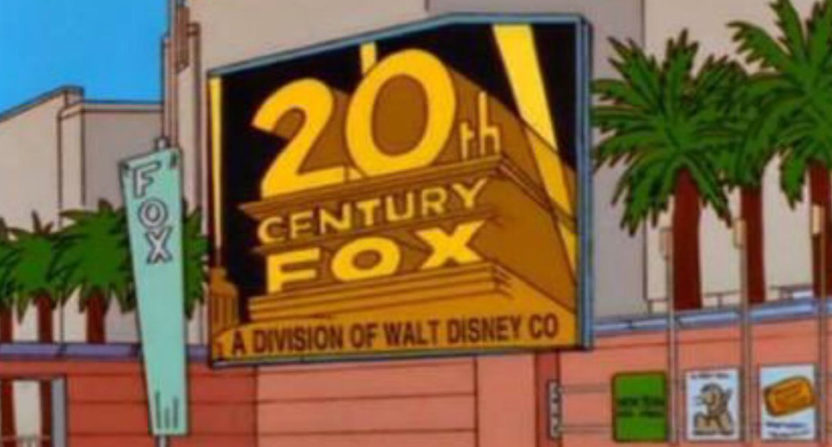

Disney’s long-discussed purchase of much of 21st Century Fox (predicted by The Simpsons almost 20 years ago) was officially announced Thursday, as expected, so it’s a good time to mull what this transaction could mean for the sports world if it gains regulatory approval.

There are major potential effects for ESPN, for the 22 regional Fox Sports networks included in the deal, and for the remaining Fox Sports properties (FS1, FS2, their stake in and operation of the Big Ten Network, and the sports content on the Fox broadcast network).

For ESPN: Synergies, stability, and streaming

The regional sports networks are an important part of this deal, with the overall deal being valued at $52.4 billion and estimates of the regional networks’ value coming in from $20 to $22 billion. And that’s just what they’re worth now; there’s reason to believe they could be worth more to Disney and ESPN.

For one thing, there’s the carriage deals; ESPN has long been known for being able to gain favorable carriage for their other channels thanks to the demand for their primary channel (even if they’re putting less emphasis on carriage of some smaller channels recently), and that could be a big help for some of the RSNs. Disney now controls a whole lot of the sports TV marketplace, and that’s important when it comes to carriage deals. (However, as AT&T-Time Warner shows, regulatory approval may not be easy, and promises about not pulling channels may be required.)

Beyond that, there are all sorts of possible ways to integrate RSNs on the content side. RSNs could air ESPN studio programming in addition to their own local content when they’re not showing games, while ESPN could pick up reports from RSN talent, going to a reporter with one of those networks when there’s a big story involving that team instead of sending one of their national people. There could also be regional editions of shows like SportsCenter, Baseball Tonight, or the like that could air across multiple RSNs in one area. Disney CEO Bob Iger has already mentioned the content sharing in loose terms:

Iger: "There will be a sharing of product so that we can infuse ESPN national with some more local content" and vice-a-versa. "The result will be that both will be better."

— John Ourand (@Ourand_Puck) December 14, 2017

It should be noted that this comes with costs and risks, though. Programming efficiencies tend to mean job losses, and while ESPN’s already laid off a lot of people this year, more layoffs could follow any RSN integration. And while these networks could potentially fit nicely with ESPN, it’s notable that they never slotted in with Fox Sports 1 all that well.

Part of that’s about FS1’s own challenges, but there are hurdles to making this work. And as Peter Kafka writes at Recode, this means that Disney is now paying for even more expensive sports rights deals, many of which are locked up for quite a while. They’re betting that there are still going to be enough pay-TV subscribers to make this a good long-term play, but that isn’t automatic; the desire to get out of local sports is part of why Fox’s Rupert Murdoch made this deal. Disney has more scale and more synergies that give them an advantage in making RSNs work over Fox, but that doesn’t mean it’s a sure thing.

The latest

- Could NFL see next Saudi sportswashing controversy?

- ESPN and NBA have reportedly ‘essentially come to terms’ on deal that would keep Finals on ABC

- G/O Media sells The Onion to ‘Global Tetrahedron,’ ex-NBC reporter Ben Collins to serve as CEO

- Eli Gold on Alabama exit: ‘You can’t argue with city hall.’

Even if Iger had left in 2019, that might not have led to drastic changes right away (at least through Skipper’s tenure), but Iger staying on longer is another move for stability at the top and for the continuation of ESPN’s current plans.

The streaming front is well worth discussing too, as there are plenty of possibilities there. For one, this deal includes international services Star and Sky, and it’s been mentioned that ESPN can pick up some plans from what they’ve been doing with streaming. There are also perhaps chances to integrate Star and Sky with ESPN’s own international programming, and to integrate them on the content side as well.

But there’s also streaming as it applies to RSNs. Not a whole lot can necessarily change there immediately given the rights that are already locked up, but in-market streaming to authenticated subscribers has become a bigger deal recently, and there could be synergies with ESPN and its streaming offerings on that front.

Competitor NBC/Comcast has also started launching some regional over-the-top streaming packages, and maybe there’s a model there for ESPN to follow. And while rights deals may limit what can be done with the RSNs and streaming for the moment, owning both ESPN and RSNs could give Disney some flexibility to pick up rights for ESPN Plus in the next round of negotiations, which could be very useful if the marketplace moves even more towards over-the-top.

Speaking of that, another important element of this deal is Disney picking up majority control of Hulu. That gives them their own digital multichannel video provider carrying live TV, including live sports. And those digital MVPDs have been repeatedly cited as an important growing segment for ESPN, including by Skipper this week. Well, now they have one that’s in the corporate family.

For Fox: A partial move away from sports

This deal doesn’t mean Fox is abandoning sports altogether, of course. Sports is still a vital part of the remaining properties, especially when it comes to big events like the World Series, the Super Bowl and big college games carried on the broadcast network. Sports is still the biggest part of what actually draws live viewers, and Fox isn’t giving that up.

And as mentioned above, FS1 and FS2 weren’t that highly integrated with the regional networks, so it’s not like they’ll be massively hit there. But Fox did promote its FS1 shows on its regional networks, and that’s going away. There’s also the branding side; all the Fox Sports names in the regional networks at least got people thinking about Fox and their involvement in sports.

Maybe most importantly, there’s the long term. As previously discussed, selling the RSNs is at least partly thanks to Murdoch being not that high on their future, given the rising rights fees for sports and the growing amount of cord-cutters. Is that logic going to extend to future rights deals for the Fox broadcast network, FS1 and FS2? We’ll see. Even if Fox does still want rights, it could become tougher to compete with Disney and their scale in future deals.

For the RSNs: more integration, and a company that believes in them

Many of the possible impacts for regional sports networks have been discussed above from the ESPN side, but those effects will be important on the local side as well. For one, there are likely to be some jobs lost down the road, especially if ESPN content becomes highly integrated with the RSNs. Efficiencies may be good for companies, but they’re not good for the people previously doing whatever jobs get eliminated or combined.

But for those who remain, there could be extra opportunities, from appearing on national ESPN feeds to discuss certain stories to perhaps even a larger and easier path to national work. ESPN now has a much larger pool of affiliated in-house talent to draw from.

Beyond that, the RSNs as a whole could get some boosts from their connection to ESPN. Consider streaming; they’ll presumably eventually be able to draw on BAMTech’s services and expertise there instead of the much-criticized Fox Sports Go, and if more authenticated or OTT streaming is done down the road, they’ll be tied to a company very involved in that. Consider the carriage deals; it may be a lot harder for providers to hold out against ESPN and Disney than it was against Fox.

But the biggest part of this may be that Fox was souring on RSNs, and that ESPN clearly believes they still have a major role to play. That could mean a whole lot for the future of these networks.