For years, the coming digital revolution in sports media has been viewed as a when, not if, paradigm. Some data points do point in that direction.

To underscore just a few: digital outlets from Amazon Prime to Apple + scooping up exclusive NFL and MLS rights, respectively; the continued erosion of the cable TV bundle; and ESPN’s commitment to stream the network.

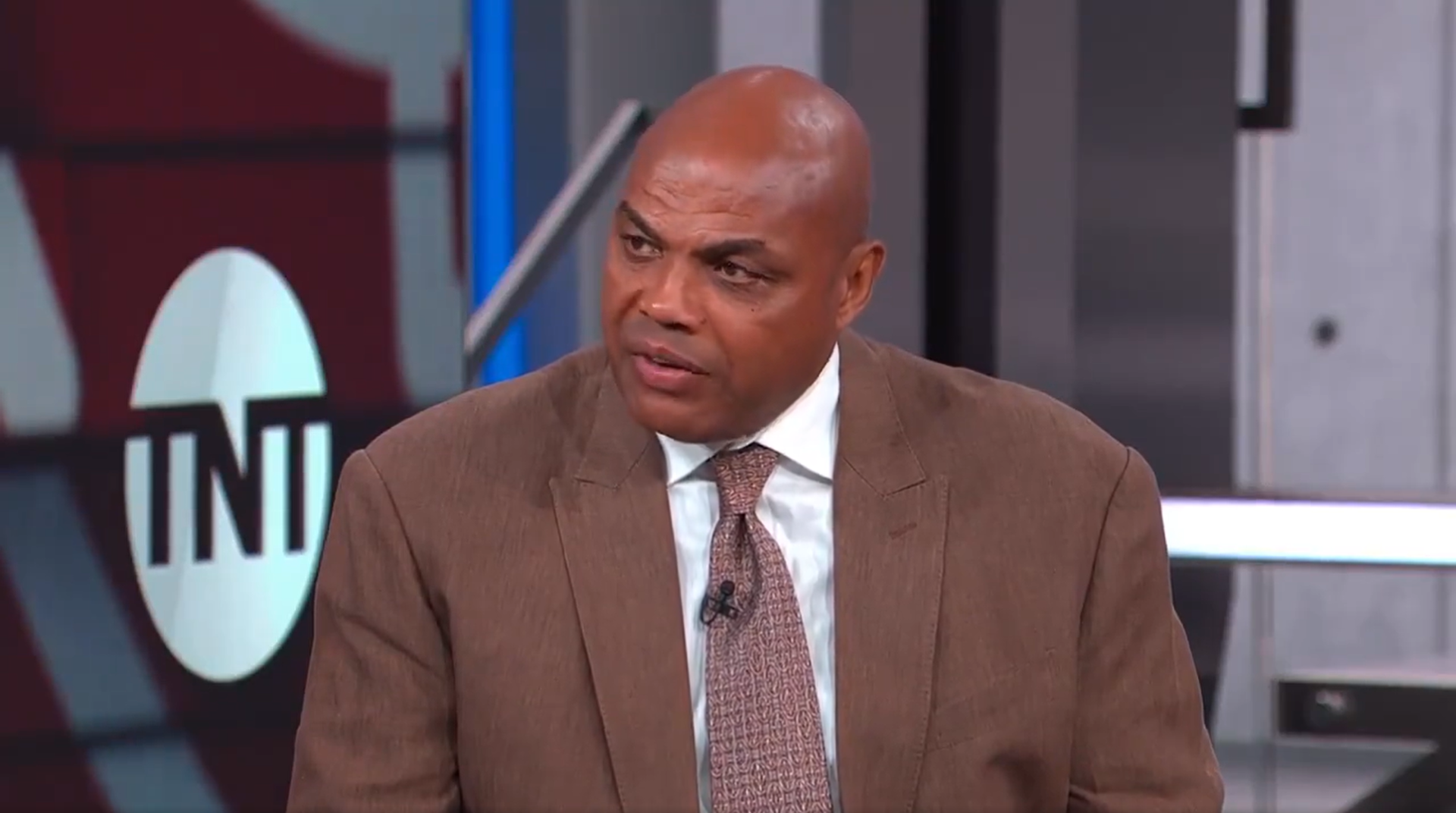

So what should be made of the English Premier League’s latest media deal, a back-to-the-future package? Two pay-TV providers, Sky and TNT Sports, retained the rights worth 6.7 billion British pounds (currently worth $8.5 billion) to air EPL games in the United Kingdom from 2025 to 2029. Amazon, which has 20 games in the current package, declined to bid.

This followed Apple lowballing the Pac-12 Conference for its media rights, offering roughly $25 million annually per school, far below the average elsewhere in the Power 5. Amazon did not even entertain an offer, and Apple’s meager pitch ended the conference.

Is this a harbinger that the digital lucre sports leagues are counting on may not emerge and fill the deficit from a shrinking pay-TV universe?

“There’s the narrative about, I guess it kind of all coalesced into this idea, is that if Amazon wanted to be involved in sports, they would want to be involved in sports in the way that ESPN or Fox Sports, or Sky Sports, right, or, or NBC or CBS is,” said media consultant Patrick Crakes. “Beware the narrative.”

Outlets like Amazon and Apple are distinctly different from the traditional sports TV ecosystem, not just because of the distribution platform. ESPN and Fox Sports have tremendous programming blocks to fill; they need more and more sports content at specified times. However, Amazon Prime and Apple + don’t have that burden, nor the urgent need to be at nearly every sports rights auction.

‘’They don’t have to program 24/7,” said media consultant Ed Desser. “They’ve got a different methodology for choosing what they want to do.”

For Amazon, that methodology revolves around Prime subscriptions. Because it is so easy to cancel a digital sub–unlike cable–Amazon’s focus is having sports programming every month, so fans have a reason to retain their service.

“If you’re watching Amazon for sports, it’s for certain specific sports,” Desser said. “And you may decide, ‘I’ll be in this month and out next month,’ and that’s what they have to program for. And in that respect, it is a bit like a traditional network. It’s just that they don’t have to fill 24 hours; they just have to sell 12 months.”

Desser does not believe that media deals are a red flag for the sports industry. The 20 games Amazon currently has are scheduled during holidays and are viewed in the UK as less desirable than others. Still, that wouldn’t have prevented Amazon from bidding for the more extensive packages.

Amazon Prime continues to add incrementally in the U.S. following its $11 billion Thursday Night Football deal. Recently, it signed on to air five NASCAR races starting in 2025. Prime is part of a melange of outlets that inked a new pact with the NWSL (though one source cautioned the cumulative $60 million per year figure touted in the media for the league’s take is not all cash but includes media buys). Earlier this week, they announced Premier Boxing Champions will be coming to Prime Video next year on a multiyear deal

But the EPL is not the only sport Amazon has said no to. It wouldn’t be overbid for the Xfinity race series, which went to the over-the-air network CW. And it wasn’t in the bidding for the Pac-12.

The two big sports deals on the horizon are the College Football Championship and the NBA. Like all such pending transactions, Amazon’s name is bandied about because it has a lot of money and the view that digital will take over with the cable bundle on shaky ground.

In the NBA’s case, there are reasons to think Amazon will make a push. ESPN and Warner Bros. Discovery, which shares the current package, have financial questions stemming from cord-cutting and are seen as wanting fewer games. That should open up a not-insignificant streaming package.

Crakes, however, cautions Amazon has had the NFL for nearly two seasons and has yet to make anything close to that kind of investment since. “Maybe they have enough, or maybe at some point, they’re gonna have enough,” he said. “There’s this assumption that they want to be Fox Sports, ESPN, NBC Sports. What if they want to get what they need for what they think makes sense? Right? And maybe Thursday Night Football is enough with five NASCAR races; by the way, five NASCAR races feel like an experiment.

“They’ve also not just not spending nilly willy nilly everywhere, right? And I don’t think anyone should expect that anymore. And by the way, it was unfair to ever expect that of them.”