A big question with over-the-top subscription service DAZN is what they’re able to offer in the U.S. outside of their combat-sports-heavy (boxing and Bellator MMA) focus so far. They’ve also paid big for the ability to show nightly MLB whiparound show ChangeUp. But that’s still a pretty limited lineup compared to the extensive rights they have in the many other countries they operate in, and with their monthly fee doubling to $19.99 for new users (there are still deals available for existing users and those who buy an annual plan, though) and with plenty of other subscription services out there, they’ll likely have to pick up other rights to really make much inroads beyond boxing.

That’s easier said than done, though, as just about all the major U.S. rights are locked up for at least the next few years. While DAZN’s corporate backers have a lot of money (they’re owned by billionaire Len Blavatnik’s Access Industries), and while DAZN itself may be able to raise more for rights bids with the discussed sale of some of its Perform content unit (specifically focusing on stats and sports betting information), that’s not all that helpful for a company looking to grow immediately. But there is something that could be a logical fit; NFL Sunday Ticket.

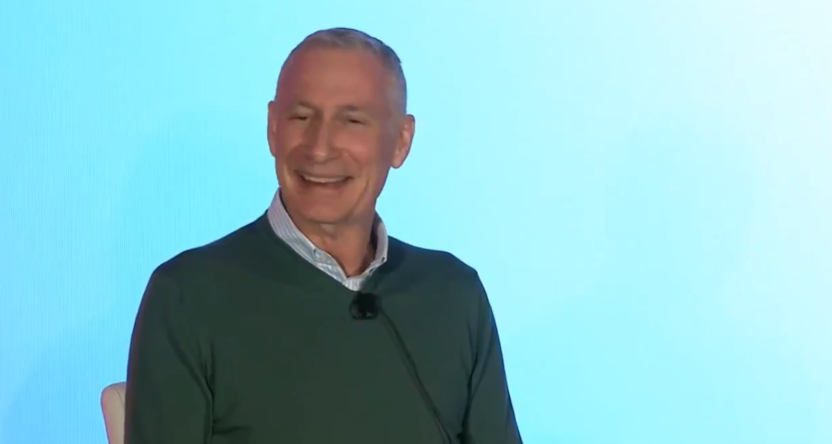

That package is exclusively with DirecTV through 2019, but the NFL has an opt-out option after that, and it’s sounding like they may try to sell it to both DirecTV and a streaming service. And comments that DAZN executive chairman John Skipper made this week in a pair of interviews illustrated DAZN’s desire to push for U.S. content, the struggles they face in getting exclusive live rights right now, the need they have for content and how they “hung up a sign” with ChangeUp that they’re interested in more than just exclusive live rights. All of that (plus their previous NFL deals; they have live and on-demand NFL rights in Austria, Germany, Japan, Switzerland and Canada) sounds like they might be in the Sunday Ticket mix. Here’s one interview Skipper gave this week at Sports Business Journal‘s World Congress:

.@daznglobal's John Skipper on the rights available for DAZN to acquire in the US. #sbjwcs pic.twitter.com/ODmfoFbrKe

— Sports Business Journal (@SBJ) April 3, 2019

And a transcription:

Skipper’s asked “Are there enough rights out there for DAZN to keep acquiring in the United States? Outside of combat,” and he responds “Before you added the last part, there are lots of rights available (laughs). This is by far the most difficult and anomalous market, right because most places in the world you have short-term deals. Most places in the world you don’t have five, six, seven large, well-capitalized players, you have one or two. There is lots of quicker opportunity around the rest of the globe, which is why we launched in Germany and Japan. We launched recently in Italy and Spain. We’re launching in Brazil next month. In the US we launched around a specific sport, which was not captive to the same companies because of its move into PPV as its principal money-making operation. There is opportunity there for us, and that’s why we’re in that.”

The next question is “But you also rolled out this week a baseball wraparound show as part of a deal with baseball,” and Skipper responds “Which is pretty clearly intended to send a signal that we are interested in the major sports in this country. They don’t happen to have their live events available, but we basically hung up a sign with that show, and it’s a pretty good show if you haven’t had a chance to see it, to say that we expect to be a player in the next round of deals.

Lastly, the host says “And a report last night Perform may be sold by your owner to free up some revenue to buy rights?” and Skipper responds “We are in a… these are thoughts that were crafted for me carefully. (Audience laughter.) We are in a discussion to sell some of those rights, that is an accurate report. But we are in the midst of that, not the conclusion of it. At the conclusion of it, we will announce something. But it will be to raise capital for the faster-growing businesses over the top.”

The “hung up a sign” comment feels particularly notable, as it makes it clear that DAZN views ChangeUp not just in its own right, but as a potential stepping-stone to other deals. Now, that’s not necessarily Sunday Ticket; there could be other whiparound shows out there, or other non-exclusive deals, or this could be talk just about making bigger bids when big properties do come up in a couple of years. But Sunday Ticket seems like something that would be a logical target for DAZN, and something that they could potentially get much sooner than those other rights.

And DAZN does seem intent on growing their U.S. presence beyond combat sports. In another interview this week on The Bill Simmons Podcast (DAZN is sponsoring The Ringer and Simmons’ podcast for three months; we previously discussed Skipper’s comments on that sponsorship, and his comments on how he and Simmons handled Simmons’ ESPN exit), Skipper spoke about his desire to expand DAZN’s U.S. audience beyond boxing. Here’s that podcast, with the part in question starting around 1:29:50:

Skipper’s talking about the challenges of having too many subscription services, and Simmons asks “So where does DAZN fit into this? You’re doing boxing. You’re doing this MLB whiparound show, MMA, you have a bunch of soccer.” Skipper responds “That’s in the United States. We have some rugby and some cricket. Look, we made a pragmatic and opportunistic decision that boxing is the one sport that isn’t managed overwhelmingly by NBC, ESPN, CBS, because it had disappeared into a PPV world. And I suspect, I’m looking at your poster here of Ali-Frazier, which would lead me to believe, you and I have never talked much about boxing, but we both grew up when you cared about boxing.”

Simmons then says I still care,” and Skipper responds “And pay-per-view removed boxing from the mainstream and suppressed the audience to be for most fights, some hundreds of thousands of people who are willing to pay $80 to see Earl Spence and Mikey Garcia box. Actually turns out to be about 350,000 people. They happen to be very talented boxers who almost nobody in this country has heard of and we are going to try to restore it where they appear in front of big audiences for an affordable subscription price.” Simmons then says “And it’s a ridiculously loyal audience” and Skipper responds “It’s a very loyal audience that cares a lot about it. I think it can be a broader audience.”

Simmons responds “ESPN helps with that. The fact that they are putting stuff on basic cable.” Skipper replies with “Look, I believed in that. I did the Top Rank deal with the idea that we were going to bring big fights. The first one we did was [Manny] Pacquiao and Jeff Horn from Australia that we wanted to get in front of a big audience. And they attracted some big audiences. And our business model is different. We think ultimately we will end up with a large base of subscribers and for $100 per year they will be thrilled to get six, or eight, or ten, I hope, pay-per-view quality fights. It’s a great value.”

The latest

- Could NFL see next Saudi sportswashing controversy?

- ESPN and NBA have reportedly ‘essentially come to terms’ on deal that would keep Finals on ABC

- G/O Media sells The Onion to ‘Global Tetrahedron,’ ex-NBC reporter Ben Collins to serve as CEO

- Eli Gold on Alabama exit: ‘You can’t argue with city hall.’

“Then we do have to figure out, the baseball show is the first tip, we have to figure out how to get other content. Be a multi-sports aggregation. And we have to figure out the other issue that I think everybody wrestles with, which is one size fits all probably is not the end game. We probably need to have tiered pricing and figure out other ways, because now we’re twenty bucks and I think it’s a great proposition for boxing fans. But what if we had gone in to get the American Athletic Conference? Which, by the way, has some appeal. We thought about it, but ESPN never let it come to market.”

“But now it’s a $20 barrier to entry. I don’t know, you gotta figure out some way to make that conference available for six bucks, or nine bucks a month. We’re gonna figure that out. We have a really good proposition, I think. We are the exclusive home to Canelo, Golovkin, and Anthony Joshua, and Danny Jacobs and Demetrius Andrade…”

They then talk about the rumors around Deontay Wilder a bit, with Skipper saying DAZN is interested in him, but Wilder’s camp has to figure out if they’d prefer just pay-per-views. Simmons then asks “So what’s the ceiling, then?”, Skipper responds “For?”, and Simmons says “You look at the next four years. Will you become a major player with some of these rights that are going to be popping up?” Skipper then gives a long answer:

“I believe that we’ll have a robust and profitable direct to consumer subscription service in a pretty quick time frame in the United States. And remember we’re not a U.S. business; we’re a global business. Our biggest businesses right now are in Japan, Germany, Italy… We’ve launched in Spain, we’ll launch in Brazil in the next month. We are a first mover and trying to capture around the globe; go in and be first mover. We’ve got good technology, we are buying rights… the US is an anomalous market in the world, the biggest market in the world. We can’t ignore it, we’ve got to be here.”

“We are in Japan, we have the J-League. We have Japanese baseball. We have Major League Baseball. We have more baseball than anybody in a country for whom baseball is one of the two most important sports, along with soccer… and we have more soccer in there. So that’s a different market. Germany, we have Champions League. Italy,we have Serie-A. In Brazil we will have a lot of international rights, we will be able to create a niche service. We’re not a niche service in Japan, we are one of the two major players in Japan now. But we need presence in New York, not New York, the U.S., because it’s where the financial markets are and where big investors are.”

“So we’ve got to figure out a proposition, I think cleverly. I just joined ten months ago and they’d already figured out the boxing proposition. I’ve simply tried to help make it by going and getting a deal… I did do a lot of sports deals. So I went and helped do the deal to get Canelo…we now have the most important Hispanic fighter, the most important Western European fighter, and the most important Eastern European fighter. So yeah, would I like to have the most important U.S. fighter? I would.”

“And I don’t mean that as poaching, I don’t mean that as to send a signal to anybody, you just simply ask me we would love to figure out a way to have Deontay Wilder fight Anthony Joshua. Because it’s a fight fans won’t… but I’m not trying to intrude on their businesses. They have good business to do as well. We are going to try to figure out…right now, business models are in the way of that happening and business models are real things. People are trying to make a living.”

That interview’s notable both for the suggestion of possible tiered pricing (which could give DAZN some flexibility to pick up smaller conferences and court those fans, even if they don’t care about boxing) and for the discussion of the global markets and how DAZN fits in there. And both “A robust and profitable direct to consumer subscription service in a pretty quick time frame in the United States” and “We need presence in the U.S.” make it sound like DAZN is going to be ambitious and aggressive with going after non-boxing U.S. rights. Will that be Sunday Ticket? We’ll have to wait and see, as the NFL hasn’t even decided if they’re going to opt out of that deal yet. But it certainly seems like a likely DAZN target.

[Sports Business Journal on Twitter]