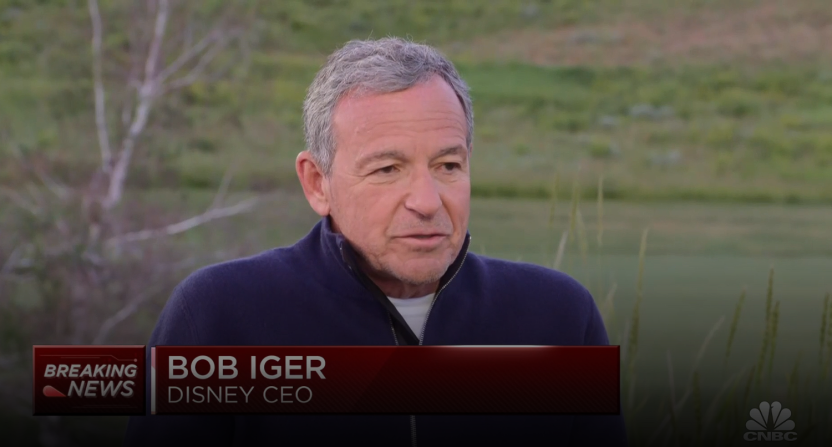

One day after receiving a contract extension through 2026, Disney CEO Bob Iger went on CNBC with anchor David Faber and made a lot of news. Iger addressed a wide range of topics, including the ongoing Writers’ Guild of America strike and a potential Screen Actors Guild – American Federation of Television and Radio Artists strike. But perhaps of most note here is what he had to say about the future of ABC and ESPN.

There, Iger discussed Disney’s linear networks (ABC, the ESPN networks, the FX networks, the NatGeo networks, and the Disney-branded networks). He said ABC (where Disney owns the overall network, but only has eight owned-and-operated affiliates out of the more than 230) and the other non-ESPN linear networks “may not be core” to the company going forward. And while he was more positive on ESPN and sports, he said Disney may even look for “strategic partners” there, particularly around the company’s plans to launch a full direct-to-consumer version of the main ESPN network in the next few years. Here’s the key part of that interview:

Here’s some further discussion of that, from Alex Weprin of The Hollywood Reporter:

Iger also addressed the future of Disney write large, suggesting that the ABC broadcast network “may not be core” to the company, and that he has held discussions with potential “strategic partners” for ESPN, which could help the sports giant move to a direct-to-consumer model.

Perhaps most notable was his comments about ESPN, which he says is valuable due to the value driven by live sports. Iger says that “we’ve had conversations” with potential partners for ESPN, and that “we want to stay in the sports business.”

“Whether it’s content value, whether it’s distribution value, whether it’s capital, whether it just helps the risk of the business some extent, but that wouldn’t be the primary driver,” he elaborated. “But if they come to the table with value that enables ESPN to make a transition to its direct-to-consumer offering, then we’re gonna be very open minded about that.”

On ABC and its local stations, Iger said that “we have to be open minded and objective about the future of those businesses,” agreeing with interviewer David Faber that they “may not be core” to the company.

“There’s clearly creativity and content that they created at its core to Disney, but the distribution model, the business model that forms the underpinning of that business and that has delivered great profits over the years, is definitely broken,” Iger added.

Here’s more on that from CNBC’s Lillian Rizzo:

“After coming back, I realized the company is facing a lot of challenges, some of them self inflicted,” Iger told CNBC’s Faber on Thursday, noting he’s accomplished a lot of work in seven months but there’s more to be done.

At the top of the list is assessing the traditional TV business, Iger said on Thursday. Disney owns a portfolio of TV networks, from broadcast station ABC to cable-TV channels like ESPN.

Disney is going to be “expansive” in its thinking about the traditional TV business, leaving the door open to a possible sale of the networks. “They may not be core to Disney,” Iger said, adding the creativity that has come from those networks has been key for Disney.

Cable-TV channel ESPN is in a different bucket, however. On that front, Iger said Disney is open to finding a strategic partner, which could take the form of a joint venture or offloading an ownership stake.

Iger said when he had left the company he had predicted the future of traditional TV and had been “very pessimistic,” and has found since his return that he was right in his thinking, adding it’s worse than he expected.

Those are certainly notable comments from Iger, perhaps especially when it comes to ABC. There hasn’t been a lot of recent discussion of dividing up ABC and ESPN, which have long been linked. Indeed, ABC bought 10 percent of ESPN from Getty Oil in 1982, upping that stake to 80 percent in 1984, and both were brought into Disney together in that company’s 1996 acquisition of ABC/Capital Cities (which merged in 1986). As many have explored (including Jim Miller in his Those Guys Have All The Fun ESPN oral history), ABC was largely seen as the bigger part of that deal at the time, but that soon flipped with the money ESPN was raking in off per-subscriber fees (especially after the 2006 move of Monday Night Football there). And yes, there was some discussion of Disney selling off ABC (but not ESPN) in the early 2010s, with private equity firms even retained, but those fell apart, with part of that even being about an insider trading tip.

In recent years, though, ABC’s importance has again seemed to be on the rise, especially to ESPN and to the wider sports world. In a world of heavy and increasing cord-cutting, the reach divide between broadcast TV and cable has widened. And that’s led to more and more ESPN rights deals including at least some broadcasts on ABC. A few of the many notable recent and current ones there (with years only including the most recent runs, not ABC’s entire history broadcasting the sport) include the NFL (select simulcasts of Monday Night Football games since 2020, select ABC-exclusive MNF broadcasts since 2022, original NFL Draft coverage since 2019, NFL Wild Card simulcasts since 2015, NFL Divisional Round game beginning this fall, Super Bowls beginning in 2025), the NBA (the NBA Finals and other playoff games since 2003, regular-season and Christmas games since 2002, NBA Draft since 2021), college football (since 2006 with Saturday Night Football, plenty of other games, SEC afternoon games beginning in 2024), MLB (Wild Card games since 2022), the NHL (since 2022, including the Stanley Cup Final every other year), the WNBA (since 2003), Formula 1 (since 2021), and much, much more. And even ESPN rights deals for less-prominent sports these days often include some ABC presence.

Of course, a sale doesn’t have to end all programming agreements. It’s certainly possible that some to all of that content could remain with ABC even if it wasn’t owned by Disney. And it is notable that unlike most of the other linear networks mentioned above (the NatGeo ones are an exception, with NatGeo having its own stake in those), Disney isn’t pulling in all of the “ABC” revenue; they own the network, but as discussed above, they only own eight of the affiliates.

But still, the idea of selling off ABC separately from ESPN would be a big jump from what Disney has done in the past. Even many of the “Disney should spin off ESPN!” arguments (which have been advanced for a decade-plus with little to suggest Disney would actually do that, and with those looking less and less likely now) have suggested that ABC should be included in a spinoff or sale. So it’s interesting to see that potentially changing, and to see that change coming around a different perceived status for ESPN (which Iger indicates Disney wants to keep, but is looking at possible strategic investment for around the DTC plans).

Executive comments in an interview don’t necessarily indicate imminent change, of course. And it’s worth keeping in mind that the “they may not be core” remark included “may” and was in response to a comment from Faber to that extent, not independently brought up. But Iger has been given a substantial mandate to remake Disney following his “Somehow, he returned” November 2022 comeback, and that’s been further bolstered by this extension through 2026. And his comments here certainly suggest that he’s looking at big swings, and that those might include moving on from ABC.

[The Hollywood Reporter, CNBC]