With Texas and Oklahoma reportedly close to joining the SEC, and discussions of ESPN’s role in making this happen and the benefits they could see from it, it’s worth looking at why they might make that move and why the SEC (barring Texas A&M, which appears likely to vote no) would be willing to accept them. The obvious reason is money, which has been the number-one reason behind most of the conference realignment of the last decade-plus. But it’s worth looking at just how much money might be needed to make this at least a revenue-neutral move for the other SEC members, if not a revenue-positive one. And given that most of the numbers involved have been reported at one point or another, we can do some math there and come up with some pretty good estimates.

The key recent reporting on this comes from a Sports Illustrated piece by Ross Dellenger in May, which was about the SEC distributing $23 million immediately to each of its members (to help offset COVID-19 losses) in the form of a loan taken against future media rights revenues. We covered that piece then, and talked about how it showed how lucrative the conference’s media rights (from the 2024-25 season onwards, when their new ESPN deal kicks in) are.

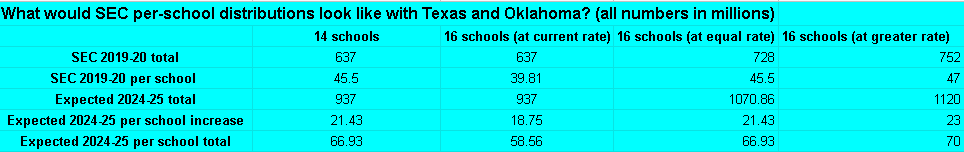

The two key numbers in there are the 2019-20 per-school distribution ($45.5 million per school, which, multiplied by 14 members, gives $637 million in central conference revenues to be distributed) and the expected boost of $300 million per year conference-wide from 2024-25 on (which, divided by 14 members, is $21.4 million per school, leading to a total of $66.9 million per school each year). That provides the foundation to run what the current and future per-school numbers would look like if the league went to 16 schools (with Texas and Oklahoma) under three scenarios: no change to the central pot, enough change to the central pot to keep the per-school numbers equal to now, and enough change to the central pot to grow the numbers to $70 million per school annually. Here’s what that looks like.

(One note on this: the greater rate numbers are based on starting with $70 million per school and working backwards. The $23 million increase and $47 million current would be adjusted based on when Texas and Oklahoma join and when that greater rate kicks in. If they wait to move until 2024-25, which would also help with lessened penalties for exiting the Big 12, the 2024-25 increase would change to $24.5 million per school, while the 2019-20 per school number would stay at $45.5 million. But the key element in this chart is that bottom-row total, not the components of it.)

Running those numbers makes it clear that if an offer of this sort is on the table, this would be logical for Texas and Oklahoma on the money side (and, again, that’s the only side that really matters). Yes, those schools have some advantages in the current Big 12, especially on the competitive side; many of their conference games look much easier than they would against SEC West teams, even if some SEC West teams moved east following the addition of these schools. And yes, the per-school numbers aren’t all that different from the SEC for now, once you factor in what Texas and Oklahoma get from being able to retain their third-tier rights (with Longhorn Network and Bally Sports respectively). But the numbers are clearly better if the SEC can maintain a per-school distribution of around $67 million annually after its new contract despite having two new members. Here’s what Max Olson wrote at The Athletic earlier this week about the current financials for Texas and Oklahoma:

The Big 12’s revenue distribution was approaching $40 million per school before the pandemic. Only having to split revenue among 10 teams has put this league comfortably in third place in distribution among the Power 5. Then add in the valuable third-tier rights that allowed Texas to bring in another $15 million a year from Longhorn Network and Oklahoma to make an extra $7 million a year. On paper, that seemed — at least to league peers — like a rather favorable arrangement.

Sure, that’s favorable in some lights. That has Texas making around $55 million a year and Oklahoma making around $47 million a year, both more than SEC schools are currently making from media rights (Thanks, Longhorn Network! And thanks for having your payout to Texas guaranteed rather than dependent on network success!). But this isn’t about the current picture; it’s about what things are going to look like for the SEC after the new ESPN deal fully kicks in in 2024-25.

Under that new deal, those per-school payouts were going to leave Oklahoma and Texas behind, and further add to the idea of a Power Two (SEC and Big Ten) rather than a Power Five. And if there’s a sense that Texas and Oklahoma can get similar per-school distributions to what SEC schools are currently expecting starting in 2024-25 (which would seem pretty necessary in order for SEC schools to be on board with this), that would boost their media distributions by around $12 million and around $20 million respectively. Money talks.

That kind of jump is an obvious gain for Oklahoma and Texas. And even the scenario where these per-school distributions stay equal could be a win for the SEC schools (minus Texas A&M, which has a lot to lose from no longer being the only SEC school in Texas). It wouldn’t give them more money from media distributions, but it would give them more security (the SEC looks even stronger with those schools in the fold) and some lucrative regular matchups (leading to better ticket sales, better TV slots, and the like).

But it’s also quite possible that what we’re talking about here is a scenario envisioning even a better per-school distribution after adding Oklahoma and Texas. One possible example of that is the $70 million figure proposed in the last column here. (To be clear, that figure is a possible estimate of what could be on the table, not reporting that that specific amount is on the table.) A better per-school distribution than the current plans would do a lot to get enough SEC members (11 of 14 are needed) onside with approving this expansion.

The latest

That current Oklahoma and Texas money comes mostly from both ESPN and Fox. But the Big 12 portion of it, $40 million a year, is only set through 2025. It’s quite possible that ESPN either doesn’t keep Big 12 rights going forward, if there is a Big 12 after this, or keeps them at a way lower rate and reallocates much of that money to a SEC deal boost. Also, while some of that Texas money is specifically from Longhorn Network, ESPN could definitely roll Longhorn Network into SEC Network and/or ESPN+ and see some benefits from that. Whether that would be quite as lucrative for them as their current Longhorn Network setup can be debated, but there are certainly ways for them to retain at least some LHN value even without the network itself.

How do we get from $102 million annually to $134 million or $183 million a year? Well, it’s worth keeping in mind that the $102 million doesn’t fully reflect the TV value of Texas and Oklahoma. An estimated $40 million of that for each school is from Big 12 TV distributions, which treat each of the conference schools equally. The likes of Baylor, Kansas State, West Virginia, and Iowa State simply aren’t worth as much for TV as Texas and Oklahoma; the $40 million average depresses the actual value of Texas and Oklahoma, and inflates the value of the other Big 12 schools.

That’s fine, because that’s how conferences work. And it’s the same story in the SEC: Alabama is worth more to TV than Missouri or Mississippi State. But it’s not all that hard to see ESPN willing to pay $32 million or even $81 million more annually than Texas and Oklahoma are currently getting in media rights (the numbers necessary for equal or enhanced distributions) for the purposes of having them in the SEC. There are major benefits to that for ESPN just from a viewership standpoint, as that now means a lot more SEC games with teams that are big TV draws (Oklahoma was the sixth-biggest draw overall in the 2019 regular season, and Texas punched above their viewership weight for an 8-5 team). And it’s possible that just the boost to the SEC from adding Oklahoma and Texas would be worth that amount of extra money. (It’s also notable that the central distributions here don’t necessarily need to come completely from ESPN for TV; this is about the general pool of conference money to distribute to schools, and while most of that is from the conference’s TV deal, that’s not all of it.)

But beyond that, there’s the context of ESPN’s competition with Fox for college football rights. As AA’s Ben Koo noted earlier, that appears to be an important factor here. After 2024-25, the SEC TV and streaming rights will be entirely owned by ESPN; the Big 12’s TV contract comes up after 2025, but it’s currently a Fox-ESPN split. Gaining full rights to the two most prominent Big 12 schools would be a major coup for ESPN against Fox, and a further establishment of ESPN as the dominant college football broadcaster.

And that might lead to further knock-on effects. If ESPN gets that dominant, that might make Fox and NBC less eager to broadcast college football in general, and that could help ESPN get other rights, including perhaps more Big Ten rights (they have the lesser half of those), more Big 12 or Pac-12 rights, and maybe even Notre Dame rights (NBC’s deal with that school also expires after 2025). So there’s an argument that ESPN might pay even more than Oklahoma and Texas are really “worth” in order to destabilize Fox and win other college football battles.

At any rate, it’s not yet completely clear that the Texas and Oklahoma move is 100 percent happening. There are a lot of potential hurdles ahead, and it’s notable that a move involving these teams has been close before but didn’t actually come to fruition (the Pac-16 attempt in 2010). And yes, while there are arguments (as detailed above) that it’s absolutely worth it for ESPN to pay most of (if not all) of the extra money to keep payments equal or boost them for a 16-team SEC featuring Oklahoma and Texas, that’s still a lot of extra cash. It is quite conceivable this doesn’t actually wind up as a done deal. But it’s worth thinking about what the money involved would have to be, and about why ESPN might be willing to pay that.