A potential bidder for live sports rights has entered the picture from way out of left field – the E.W. Scripps Co.

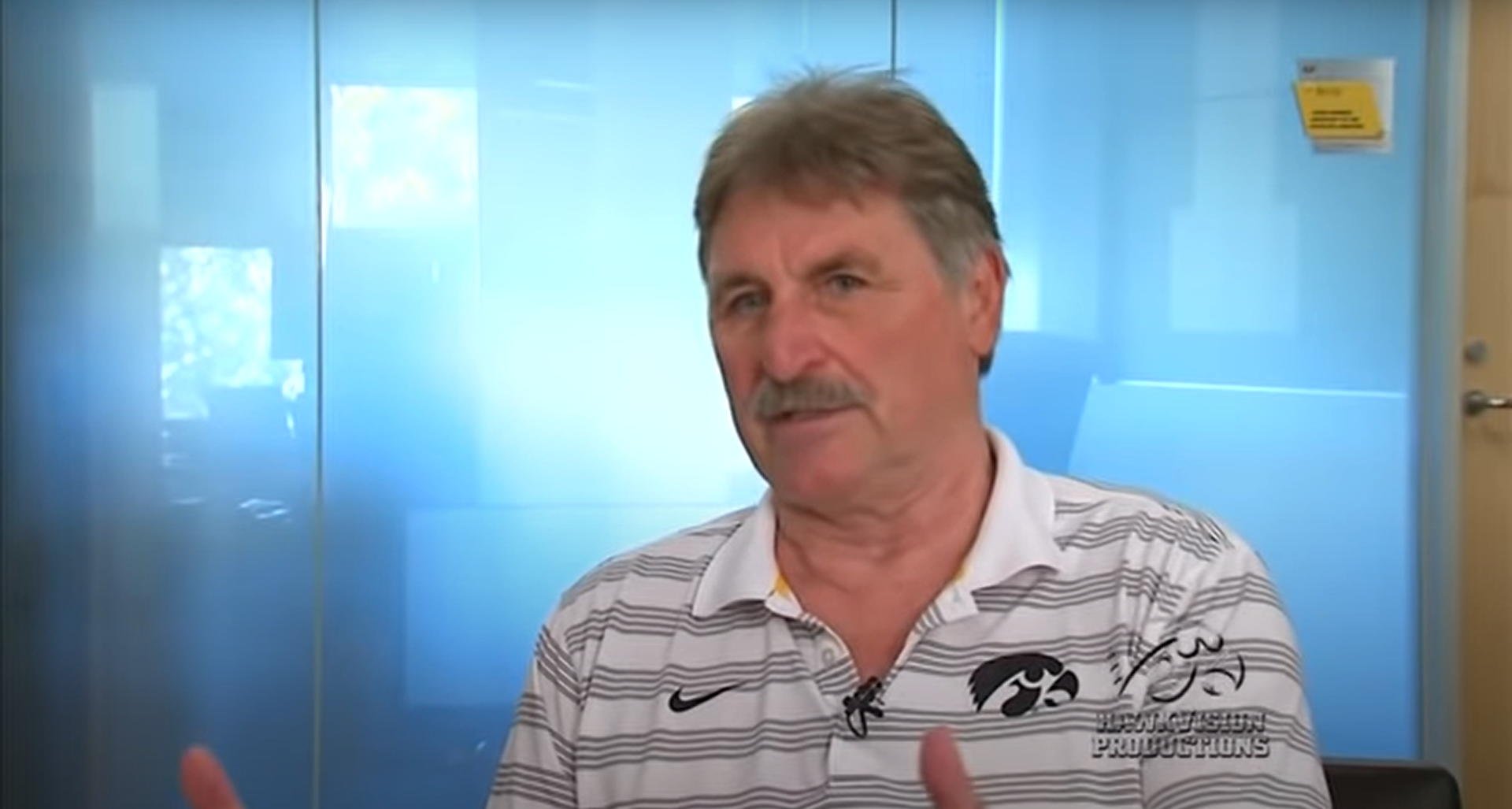

Per the Sports Business Journal, Scripps is launching a new division called Scripps Sports. Brian Lawlor, the head of Scripps’ local media division for more than a decade, will be the president of Scripps Sports. The new division will focus on both local and national rights, with the latter possibly providing content for Ion Media’s platforms (purchased by Scripps nearly two years ago).

In a release, Lawlor and Scripps President & CEO Adam Symson briefly describing the logic for launching Scripps Sports.

“There is no better way to reach every generation of sports fan than through live broadcast television,” said Adam Symson, Scripps’ president and CEO. “Scripps is working with the leagues and teams that recognize the role our assets can play in increasing reach and visibility for audience engagement.

[…]

“Sports is one of the most important content genres in television, with its consistently large and dedicated audiences,” Lawlor said. “But the sports viewing marketplace has become extremely fragmented. Cable subscriptions are down, and regional sports networks are challenged, keeping fans from watching their home teams. Between our vast number of local stations and ION, a national network that can be customized in many markets, we believe Scripps is positioned to widely showcase leagues and players that are currently limited by aging distribution deals.”

As for national targets, Scripps reportedly won’t be shooting for the stars with a property that would cost, at the least, nine figures like the NBA or NASCAR, but could focus on more affordable, higher ceiling properties like the NWSL.

But when it comes to local rights, nothing appears truly off the table, with Symson explaining why the company’s networks could appeal to teams.

The idea locally is not to re-create RSNs on over-the-air stations. Rather, Scripps wants to use sports locally to supplement its existing broadcast stations. Symson described Scripps strategy as a “fan engagement funnel,” with its local stations and national networks providing the reach that leagues and teams want at the top of the funnel. “Then they can continue to segment their super fans with other platforms down at the bottom of the funnel,” he said. “If you look at a market where we operate a second station, it’s entirely possible that the the team in that market at this point is reaching less than 50% of the households. The question teams have to ask themselves is what is the platform at the top of the funnel that best allows them to strengthen their asset over the long haul? In my opinion, leagues and teams that focus strictly on pay-TV or DTC will end up in one way or another finding themselves with impaired assets.”

I actually think there’s some solid logic here, but one league or team will need to make the leap with the rest of the sports landscape watching to see how things end up working out before there’s a massive exodus from RSNs to Scripps. MLS could have been a great entry point for Scripps into local sports before the league signed their decade-long deal with Apple. Through its ownership of Ion, Scripps has networks in plenty of major markets across the country, and the availability of Ion on ad-supported services like Amazon Freevee, the Roku Channel, and Tubi could help stem fears of cord-cutting and subscriber loss.

Based on what we know right now, I don’t think Scripps Sports is guaranteed to flip the RSN model on its head and bring live local sports into a new era. But at the very least, it’s an intriguing possibility for what the industry could look like if RSNs continue to take on water and subscribers keep ditching the cable bundle.