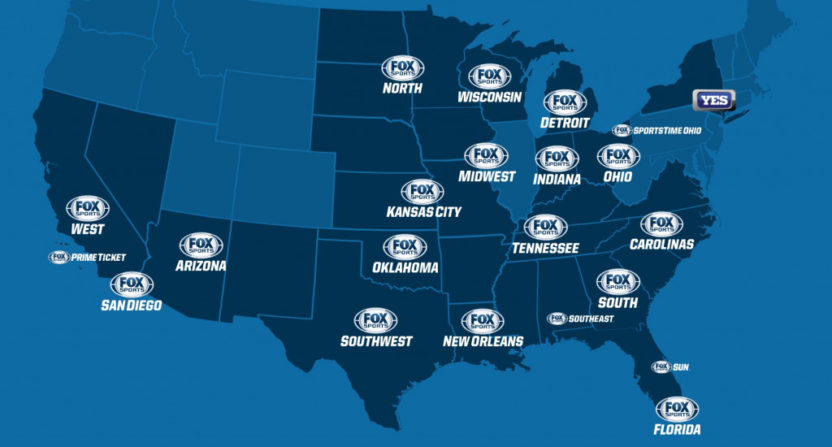

One big debate about the value of the 21 former Fox regional sports networks has been what their future distribution looks like, but new owner Sinclair (picked as the auction winner in early May) appears to have already struck a key deal there. Cablefax Daily’s Amy Maclean wrote Wednesday that a recent Wolfe Research note mentions a wide-ranging Sinclair-Charter deal that includes the RSNs:

According to a recent research note, Charter has struck a deal for renewal of Sinclair broadcast stations that includes the Fox RSNs. Charter declined to comment, but a recent Wolfe Research note declared, “CHTR renewing the Fox RSNs for a ‘slight increase’ is a nice little positive.”

Now, that part of the deal can’t be official yet considering that the Sinclair purchase of the RSNs hasn’t yet received regulatory approval, but the sides already finding agreement on carriage terms is certainly notable, especially as many were expecting significant battles to gain continued RSN carriage. That was widely cited as a reason why there were so few official bidders for the RSNs (including a lack of involvement from Charter, once considered a potential bidder themselves) and why the bids were way below the original estimates of $20-22 billion. And analyst Craig Moffett of MoffettNathanson told John Ourand of Sports Business Journal in May he had significant concerns about the RSNs’ long-term carriage future, saying “The best scenario is that RSNs are carried on the basic tier and they lose half their distribution. Their worst scenario is that they become a premium tier and they lose 75% of their distribution. It’s really hard to see any good outcome for an RSN.”

Of course, Moffett was speaking about the long-term future of RSNs rather than the immediate future, saying “Even if RSNs secure a deal that gives them 100% distribution on the basic tier for all of their traditional distribution partners, it’s not hard to imagine that they’ll get to a place within a couple of years where the universe of traditional distribution could be falling by 5-10% a year.” So that could absolutely still happen, and a Charter deal here doesn’t mean that it won’t; we don’t even know how long that renewal is for.

But a Charter deal being locked up so early (and at a “slight increase”) seems like great news for the future of these networks. The RSNs’ future carriage was widely seen as one of their largest points of vulnerability, and now Sinclair has a deal with one of the earliest-expiring providers; Charter’s RSN carriage was set to expire this fall, with only Dish’s (this summer) expiring sooner. That deal and its “slight increase” also may alleviate some distributor worries; after Sinclair was picked as the winner in May, Ourand called that “the worst possible outcome for distributors,” citing Sinclair’s reputation as a tough negotiator with its broadcast stations and suggesting they might seek big increases by bundling RSN and local station carriage.

The latest

And it’s interesting to see that, considering that Sinclair was not the preferred winner for many distributors. In fact, as Ourand wrote Wednesday, “Sources have told me that most of the distributors hoped that Liberty Media would end up with the RSNs rather than Sinclair — so much so that just before Disney sold the RSNs, Liberty got most of the top distributors to agree in principle to extend the RSNs’ affiliate deals.” But now Sinclair’s victory there doesn’t necessarily look as tough for distributors as it did previously.

It’s also maybe notable that during the auction, Ice Cube’s BIG3 claimed to the FCC and the Department of Justice that they’d been in preliminary negotiations with Charter if they should win, and that those talks had broken down to a point where Charter had refused to carry the RSNs if the BIG3 won. The BIG3 obviously didn’t win, not a surprise given the questions about their bid, and it doesn’t appear that their complaint got too far. But if you buy that Charter actually acted the way the BIG3 claims (which is a big if), it’s certainly interesting that the carriage negotiations went so much more smoothly with Sinclair. Maybe that’s about a different set of demands by the BIG3, or about their unusual and questionable programming plans, or maybe Charter was never as unwilling to carry these networks as the BIG3 suggested.

Speaking of the Department of Justice, there is also the regulatory aspect to consider here. This part of the Charter-Sinclair deal can’t be official yet because the Sinclair acquisition of the RSNs is still pending DoJ approval. But even a deal in principle here may actually prove beneficial to Sinclair during that regulatory review; many of the concerns about their RSN purchase have been about if they would demand high increases for RSNs by leveraging their local broadcast stations, and they can perhaps point to this agreement to say that they don’t plan to do that. We’ll see how that goes. At any rate, it looks like the RSNs have cleared one near-term carriage hurdle, and they’ve done so not only months ahead of the deadline, but before the sale is even officially approved.

[Cablefax]