2020 has seen some difficult times for many sports media companies, especially with most North American sports shut down for multiple months thanks to the COVID-19 pandemic before recent returns to play. Canadian digital media company theScore (which started as a TV network and associated website and app before the digital side was spun off and the TV side was sold in 2012) wound up weathering that storm in interesting ways, though; the shutdown saw them further boost their already-significant focus on esports as well as pivoting their regular sports content to longreads, quizzes and more, and sports’ returns have provided a further boost for them to leverage their theScore Bet gambling app (currently live in New Jersey, coming soon to Colorado and Indiana) with their normal sports content and with a “Sports Are Back” cashback promotion.

Aubrey Levy, theScore’s vice president of content and marketing, spoke to AA this week about how their various operations handled the sports pause and what they’re doing now. He said that theScore’s esports content was tracking well before the sports shutdowns, but the COVID-19 workplace restrictions provided some initial challenges in a shift to remote production (something we’ve also seen at other companies).

“We’ve been in the space with esports for about three or four years now, and for the past two years, have had a pretty concerted dedicated strategy, almost exclusively for our esports offerings, around video. We produce a bunch of video on demand series, seven or eight of them, and we push them out weekly, primarily for our YouTube channel. In the world of esports video, if you’re streaming, you’re largely on Twitch, if you’re doing VOD, you’re largely on YouTube.”

“Our content offering largely lives as VOD for our YouTube page, and it’s been growing pretty substantially and nicely. Even prior to the pandemic, we had crashed through a million subscribers, a million followers. And we were growing north towards 20 million views a month anyway. And then when the situation around COVID started to come into effect back in March, we obviously had to pivot pretty quickly organizationally, largely around production. It was ‘What the hell do we do?'”

Levy said theScore’s esports team was able to make those adjustments extremely quickly, though, and the from-home content wound up working well for them.

“We were shooting every day of the week. We shoot pretty nimbly, it’s not like we had a large, cumbersome studio setup, we’re pretty nimble and agile anyway, but we still had to transition all of our guys to remote work. First, it was ‘Is everyone safe, is everyone healthy? Let’s get them home.’ But a testament to our guys is that it was almost as seamless a transition as I could ask for. I don’t think we missed publishing a single episode of a single video series that we produce.”

“Anything that required on-camera talent, we shot them from home. The audience was obviously very understanding and very receptive of it given the entire world working from home. And there was an appreciation for how we pivoted the content. We were able to keep the content strategy humming, and we saw some pretty substantial uptick. There was a period where there wasn’t a lot of sports on, and that brought and amplified the spotlight to a bunch of other types of media and content. And esports, at the time and still now, absent live tournaments being played, games are still being played. So we were able to cover the goings-on around esports, and we saw pretty substantial pickup.”

Indeed they did. As per a company release on July 28 about their Q3 (period ending May 28) financial results, theScore revealed that they set an all-time quarterly record with 145 million views of their esports video content across all platforms, representing 113 percent year-over-year growth. They also set a record of 9.7 million watch hours for their esports YouTube channel (up 76 percent year over year). Levy said the records are a big positive for them, and now the focus is on sustaining the momentum on the esports side.

“It was great, it was exciting. And now it’s an effort to keep pushing it.”

He said their esports plan is to focus on compelling stories, not necessarily particular games.

“Fundamental to our strategy was to be game-agnostic. From Day 1 of our video strategy as we started to develop it, we had to accomplish a couple goals. One was that our esports content had to be equally approachable to the most hardcore demographic of any game and the non-hardcore. I don’t care if you love League (of Legends) or Counterstrike or NBA 2K, you should find as much entertainment out of the content we’re producing as your friend who might be a huge DotA fan or might not care at all about esports. And ultimately, that led to telling fundamental stories that had emotional heartbeats in and around the games. Yes, there’s gameplay involved, but you’re really looking for that underlying emotional kind of storytelling, and there hadn’t been a lot of that done in esports yet.”

“Because we were able to build up content series around that strategy, we’re pretty comfortable and confident now plugging any game into our franchise. Even prior to COVID, some of our biggest videos were about games that weren’t the conventional ‘the biggest esports today.’ We had videos for games like Tekken that would blow up and do millions of views. So we’re pretty confident in our ability to cover from a breadth and depth perspective. …We’ve also been able to broaden our coverage beyond the pro and hardcore scene to more broad-based general gaming and streamer culture.”

The latest

“I joke with our guys that they’ve been shockingly busy with nothing to cover. When all major sports got pulled back in March, it was a huge testament to our sports team [what they were able to cover]. And those are two totally-separate teams for us; we have a content team of 30 to 40 people dedicated to esports, and a larger team dedicated to our sports media business. When sports went on pause, the conversation there was ‘What are we going to cover? How are we going to keep users engaged without major live games to report on?’ Our guys found a whole new whack of formats, everything from longreads to contests to polls and quizzes.”

“Our promotional content was performing really well, and we were able to leverage our fairly-substantial social reach to keep getting people back into the app. So it wasn’t the traditional live game coverage, it was all this ancillary innovative coverage we had spun up around it. And because of the success the guys were able to do in spinning this up, we were able to retain just shy of 75 percent of our app user base (an average of 2.9 million monthly users) even without sports being back.”

Levy said the early numbers since the North American sports started returning have been very positive, too.

“When sports came back, we kind of had an indication, a feeling that there was pretty strong pent-up demand from people starting to consume again. So we basically just started rotating back into our regular coverage of sports, and some of the early data is that from the days leading up to MLB’s resumption to the days immediately afterwards, we saw our sessions double. So that was a pretty exciting indication that the users are here, the demand is there, and if we can keep this kind of high level of engagement from the content we’re putting out now with live sports on, hopefully this is a big boon.”

While theScore is a Canadian-based company, much of their audience comes from the U.S., both for esports and more traditional sports. Levy said beyond the U.S., though, their esports coverage sees some global interest, while the interest in their traditional sports content is mostly from the U.S. and Canada.

“It’s worldwide, but it’s largely led by the U.S., so our esports strategy from a media perspective is the same as our sports strategy. The U.S. is the largest market for us. Beyond that, on esports, because it’s YouTube, our viewership is very heavily dispersed as opposed to our sports business, where the U.S. is our largest market, followed by Canada, and then the rest of the world is well behind. It’s a U.S.-centric audience for us.”

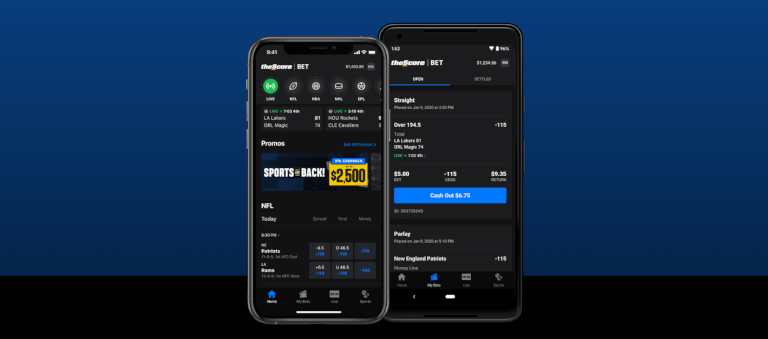

Betting is also an important focus for theScore. Levy said their overall strategy there, and their rationale for building their own sports betting app, was to offer a way for users to engage across multiple fronts, from sports content to sports betting. And he said the Sports Are Back campaign and its cashback offering was developed with that in mind.

“The thesis for us is that nobody bets in isolation. Everybody bets as part of a larger sports consumption experience. And we have a very engaged, very large addressable audience on our media property that we know bets on sports. So our job is to offer them a bet, not to treat the bet as a transactional isolated action, but to treat it as a component of their larger sports experience. That’s why we decided we would take the steps to operate our own sports book as opposed to just taking the very lucrative advertising dollars that sports books were offering to market off our audience.”

“We’ve been in market since last September, focused heavily on how we build an ecosystem of media and betting hand in hand, where we can seamlessly navigate back and forth between a media app and a betting app. And that goes into our thinking about what kind of campaigns to offer our users. The Sports are Back campaign, basically it’s a campaign where we’re giving our users five percent cash back on all bets over a 60-day period, up to $2,500.”

“A lot of times sports book promotions can get kind of murky and confusing, like the concept of bonus cash, a fairly commonly-used promotional convention for sports books; sometimes it’s pretty highly restricted on what that balance is available to do. …Why don’t we take a much more user-friendly approach, in our opinion, and just make it a cash-back offer?”

Levy said the cashback campaign was initially developed for March Madness, but then put on hold when that event was cancelled. He said it made sense for them to use it now as a way to boost engagement around the North American sports leagues returning to play.

“We’re celebrating that fact that sports are finally back on after all this hiatus. We had this bonus functionality built, we had it ready to go for March Madness, we were ready to tee it off then, and then obviously we had to pause because of no March Madness. So we had this promotional tool ready to go, and we thought ‘How do we celebrate this for our users in a way that’s fun and accessible and easy to digest, but also allows a wide range of sports bettors to find utility in this?'”

“Because it’s a cash-back offer that unlocks as you bet, for whatever level of bettor you are up to a fairly substantial amount, you can get utility in the offer. And we’re offering it not just to new sports book users, but to our existing users as well. When they come back and bet, all of their bets, win, lose or draw, will get five percent cash back. So it’s just our way of trying to take a convention that exists and figure out how to service that to our users in a way that’s more friendly.”