One of the interesting approaches to sports betting comes from theScore, which started as a Canadian TV network, evolved into a digital media company particularly known for their sports app, and then launched a betting app in New Jersey last September. The betting side has been a key focus for them recently; they’ve since expanded it to Colorado and Indiana, and have more states in the works, plus plans for Canada if and when legislation changes there.

Recently, theScore CEO and chairman John Levy spoke to Awful Announcing about their approach, and said he’s thrilled with how their betting side has grown so far. And Levy said it’s a natural outgrowth of how they took on major media companies back in the TV network days.

“It’s fricking awesome. I have to pinch myself here. It’s just like ‘We’re doing it.’ We did the same shit with The Score (during the TV channel) days; it was like ‘Who the hell are they? What is this thing?’ There was TSN, and Sportsnet, and then us. And we just put that little ticker on with the odds on it and had on-air hosts that didn’t look like your average sports broadcasters, and it really worked. So at some point I shouldn’t be surprised that we end up doing the stuff that we’re doing, but I guess I just end up so excited by it, and loving the position that we’re in.”

Levy said this year posed some challenges with the sports pause thanks to COVID-19, but they saw solid numbers after sports resumed.

“We started before COVID, got rolling last year with NFL, our first two quarters were terrific but we were just starting, and then everything closes. You know there’s going to be pent-up demand. …And the pent-up demand is really there, and we’re seeing that on both fronts. On the media front, we have our amazing app and people sort of flocked back to that to pre-COVID levels. And in terms of betting, people are coming in hand over fist, they couldn’t wait to get back in. So we’re seeing some really tremendous numbers. …Even pre-NFL in terms of the betting, we saw numbers outpacing what we did at the Super Bowl.”

Levy said the shift to a digital company and then a company with a betting side has been great for allowing theScore to expand their approach throughout North America, something they couldn’t really do as a Canadian TV channel.

“The days in Canada, it was always awesome because we knew we were going to kick butt up there. But it was constrained, right? I love being Canadian, I love the old cable days and the TV days, but your arms were around it; we knew it always only going to be Canada. This thing; once we moved into the digital space, it was like ‘Oh my god, the world’s your oyster if you just stay true to what you want to do.’ And then adding betting on top of that and doing it the way we’re doing it, which is totally different than everybody else.”

As per that difference? Levy thinks it comes from being authentic to how people talk about sports and how they bet on them, something that hasn’t always been seen from other media outlets. And he said theScore was discussing gambling and odds back in the TV days, long before any of today’s developments were on the horizon.

“This really started with the TV network and moved to the digital space, and it’s all about people’s passion for sports, and we recognized really early that people’s passion for sports included betting on sports. It’s not this monolithic thing that’s out there, it’s not ‘Oh my god, people bet on sports?’ People watch games, people play fantasy, some people sit in their underwear in their living room watching sports for 12 hours a day. And people flock to digital apps and never want to be without it. So it was always natural for us that people bet on sports.”

“So we built this brand, we built this amazing app, and we’ve got four to five million users who hit the app 120 to 140 times a month. And we know from how they use the app and from our own data and from third-party data that 50 percent of them all bet on sports. So when PASPA fell (in May 2018), that was really our ‘A-ha’ moment.”

That was a big moment for a lot of sports media companies, but they’ve taken different approaches. Some have struck advertising deals with different gambling operators, and many have launched gambling-focused content, but that content then usually directs people elsewhere to place bets. Levy said they decided to do the betting side themselves to keep it more fully integrated.

“So we asked ‘What do we want to do? Do we want to be a super-affiliate like everybody else and just suck up all this money?’ Because they’re going to throw it at you because they want to get a user base. ‘Or do we want to do it the way you should do it, which is really a more authentic approach, and basically bring betting into the media side of things and make it all one homogenous offering?'”

“And yeah, it’s got to be a separate app, and that’s tough to do. And you’ve got to have really smart engineers, which we’re fortunate to have. But bring it inside so that when people are looking at a box score, let them build a bet slip. Let them bet without even thinking that they’re moving to another app. It’s all sort of this homogenous integration of media and betting, and creating something that resembles how people think and how people act. Don’t think you know better than your users, just give it to them.”

“We know our users were taking all our data, 300 to 400 pieces of content a day, fast data, they love the brand, they love the app. Pre-PASPA falling and even now, some of them take the data and go to other betting apps. So why not just allow them to do it inside your brand and inside your ecosystem?”

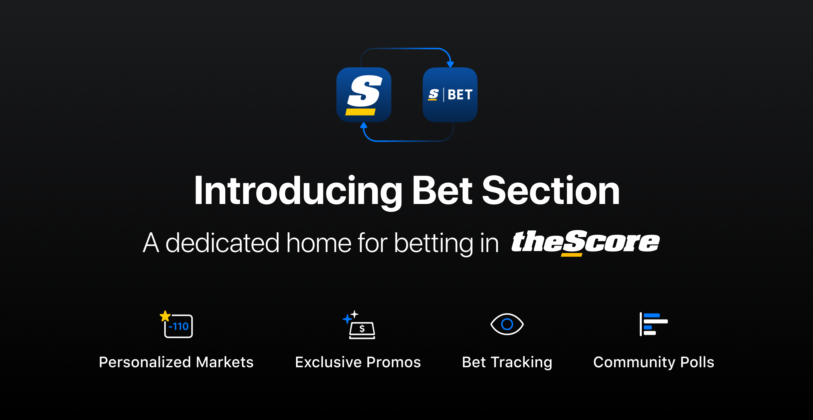

Last week, theScore rolled out a “Bet Section” to their main app, which will really enhance that integration, including tracking bets placed through theScore Bet and offering personalized betting market info based on the teams and leagues users follow. Levy said their key philosophy is to have relationships with users on both the content side and the betting side, and he thinks that’s an important differentiator for them.

“That’s totally different than what the other companies do, which is really just betting transactional apps. Some of them are better than others, but they’re just places to make a bet. And that’s why you see these megadeals happening; you have the big media companies who are never going to become betting companies themselves because they don’t want to get licensed and it’s small potatoes compared to everything else they’re doing, and then you have the betting companies that say ‘Okay, I’m spending like a drunken sailor to acquire these guys, I need some glue to keep them.’ So they go and make these deals with the media companies and cross over at the top and get a lot of publicity, their stocks go crazy. But I like our approach better, which is all in one.”

Of course, that’s the approach for the moment. And Levy wouldn’t rule out deals in the future. But he said independence has a lot of merit for them, and it would take something pretty compelling to change that.

“For us at some point, it might make some sense to do some deals, but they’ve got to really make sense, right? I’ve got to be beneficial to them a lot, and they’ve got to be beneficial to me, more than just slapping a name on something and hoping it works.”

The latest

“When you would watch ESPN, or TSN in Canada, and a guy kicked a field goal that would go over a 20 point spread, they would go, ‘Oh, that’s interesting.’ And our guys were fricking pulling their hair out because they just lost a $50 bet. That’s the essence of what the difference is. And they’re starting to get it, but they still don’t get it; they’ll talk about it now or they’ll show the odds, but they’re dipping their toes in.”

“There’s sort of this authoritarian tone of ‘We’re the experts and we’re going to tell you who to bet.’ No, that’s not what it’s like. What it’s really like, and when it really works, is when you’re just having a conversation with your users. And that’s the fundamental difference.”

He said having a lineup of writers and editors who were already in the betting world to some extent also meant that theScore’s digital content didn’t shift much after they launched their betting app.

“We always talked about betting. We didn’t have to say ‘Oh, let’s find people who know something about betting.’ Our guys knew about betting, because they were always pulling their brains out about bets. So it was very easy for them to passionately write content about it. ”

They are adding new people, though, and Levy said a particular focus is finding people (even on the local level) who have interesting angles and want to engage with readers, not just tell them who to bet on.

“It is expanding, and we are bringing more and more people on. And again, there’s the differentiation; it’s not just about finding touts or people who are just pied pipers telling people what to do, it’s finding more people who people want to engage with and talk about it.”

And Levy thinks there’s a lot of further U.S. growth potential out there, with other states starting to implement sports betting.

“We just go, go, go. The opportunities here are amazing.”

But while expanding to the U.S. has worked out well for theScore, Levy’s also really excited about what could happen with Canada. He projects single-event gambling could become legal there within the next year. And he said that’s an underserved and underrecognized market, and it’s one where they already have great brand awareness and market penetration.

“Our PASPA moment is right around the corner. …In terms of the magnitude, nobody really recognizes this because nobody really thinks about this little thing called Canada. But if you rank Ontario up against the big states in the U.S., Ontario is the equivalent of the fifth-largest state. Huge market. And most of the people who know us in the States are the people who use us; we’re the most-used least-known sports brand in the U.S.”

“But in Canada, we’re the most-used, most-known brand in the sports business on the digital side. …High levels of engagement, high levels of usage, and when sports betting takes shape up here, it’s going to be sick what we’re able to do in terms of market penetration. …I know we’re just going to kill up here.”

[Bet Section photo at top via theScore]