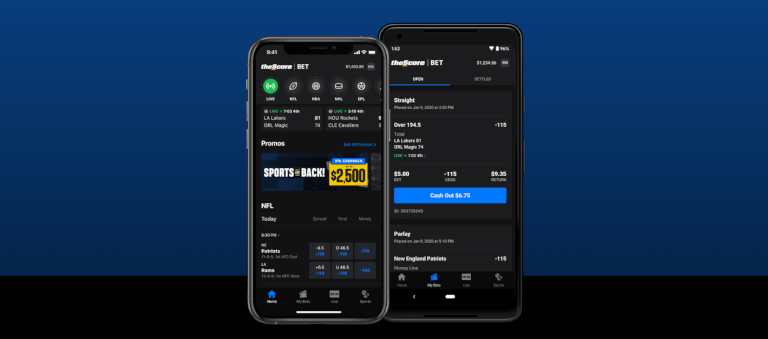

Last August, gaming company Penn National announced the acquisition of Score Media and Gaming, the parent company of sports media website/app theScore and their theScore Bet betting operation. Penn National already owned a majority stake in Barstool Sports thanks to a 2020 deal, and they described theScore as “a powerful complement to the reach of Barstool Sports” in their release announcing last year’s deal. There’s now some more detail on how that will look going forward, with theScore announcing Wednesday that they’ll discontinue their U.S. betting operations as of July 1 and pointing customers there towards Barstool Sportsbook while shifting their own focus to Canada. Here’s more on that from Matt Rybaltowski at SportsHandle:

Flourishing in its home nation since the debut of the Ontario iGaming market in April, theScore alerted customers on Wednesday that it will discontinue its U.S. sports betting operations effective July 1.

With the closure, theScore will shift focus to accelerating its growth in Ontario and expanding its technology roadmap north of the U.S. border, with the ultimate goal of migrating Barstool Sportsbook onto the company’s in-house risk and trading platform in the relatively near future.

The move comes nearly eight months after Penn National Gaming completed a $2.1 billion cash-and-stock acquisition of theScore. While Penn asserted at the time that it sought to operate theScore as a standalone business, Wednesday’s move allows theScore to strategically deploy resources in Canada, where it ranks as the nation’s most popular sports media app.

…“This move enables us to maximize the value of both brands through our organic media and gaming approach. Key to our strategy is integrating theScore media app with Barstool Sportsbook, which we’re currently working towards,” Benjie Levy, president and COO of theScore, told Sports Handle. “Bringing together theScore’s powerful mobile sports media platform with Barstool Sportsbook in a unified ecosystem, supported by our in-house technology and custom integrations, will strengthen the overall U.S. product offering and broaden its reach.”

theScore Bet was operating in New Jersey, Colorado, Iowa, and Indiana. Barstool Sportsbook is available in all of those states as well, but Rybaltowski notes that it’s not currently possible for theScore Bet customers to transfer their accounts or balances to Barstool, and it’s not clear if theScore’s obtained skins (market access agreements) in those states will easily transfer to Barstool.

There is some logic to this shift from a resource-allocation perspective. theScoreBet has gained much more traction in Canada, where the theScore brand has a long history (from the initial TV channel launched in 1994 through the since-2012 digital media company) than in the U.S., and there’s significant opportunity for expansion there as more provinces bring private-sector betting online (Ontario is the only one to do so so far). While theScore’s app has done well in the U.S. also (that release on acquisition had them as “the third most popular sports app in all of North America“), they’re not known there to the same degree they are in Canada, and theScoreBet’s share of the gambling market in the U.S. states they are in to date hasn’t been that large. And both accessing new states and deploying marketing to increase share in existing states are expensive propositions, and there’s some rationale for Penn choosing to just do Barstool Sportsbook in the U.S. so their brands aren’t competing, while having theScore focus its betting operations on Canada. (And they’ve been doing big marketing deals there, including with the Toronto Blue Jays, and they appear primed for more.)

This isn’t necessarily going to be an easy transfer of customers, though. While they’re both owned by the same company, the selling points for theScore and Barstool Sports have been quite different historically, and those properties attract at least some different customers. And Barstool as a company and founder Dave Portnoy in particular have wound up in a lot more controversy than theScore. Barstool is the much larger and more prominent brand in the U.S., though, so it makes sense that it’s the one Penn is emphasizing in a shift to a single offering in those markets.

What’s also interesting here is the emphasis on further integration between theScore and Barstool, including with that plan to tie theScore’s media app into Barstool Sportsbook. That could wind up as a significant boost for Barstool Sportsbook given the popularity of that app. And it’s also a shift focused on theScore’s in-house tech stack, which was a key part of why Penn bought them (Penn National CEO Jay Snowden said in that release last year that the path to their own tech stack via theScore “should lead to significant savings in third party platform costs and allow us to broaden our product offerings – providing the missing piece for operating at what we expect to be industry leading margins”). But this looks like theScore as less of a “stand-alone business” than was described at that time of acquisition, especially when it comes to the shuttering of their U.S. betting operations and their expanded integration with Barstool. We’ll see how this move works out for the companies involved.