What ceiling? Teams, networks and consumers have all paid what it takes to keep sports content king. Local sports rights? Solid gold, Jerry. Solid gold. So why sell?

When I first heard that ESPN was in talks to acquire Fox’s regional sports networks, I was quite shocked. Sports is the bread and butter, and affiliate fees make up 85 percent of revenue for RSNs. National Geographic Channel isn’t bringing in $5 a subscriber, so to think the RSNs aren’t covering that would be naïve. And, well, maybe they just can’t anymore.

Regional Sports rights have become a turnkey business operation. Keep the money and focus in the live events, with the rest of the programming kept uniform and cost-efficient. Lock in long-term deals with providers, share production costs with other sister RSNs, and negotiate direct.

Negotiate direct? What does that mean?

Believe it or not, there are quite a few independent providers. To get the best rate, they join and negotiate with the networks as one, known as the National Cable Telecommunications Cooperation — the NCTC. If they agree to the deal that the networks work out with NCTC, the carriage is taken care of through those terms if they decide to opt in. What’s always been left out? Regional Sports Networks.

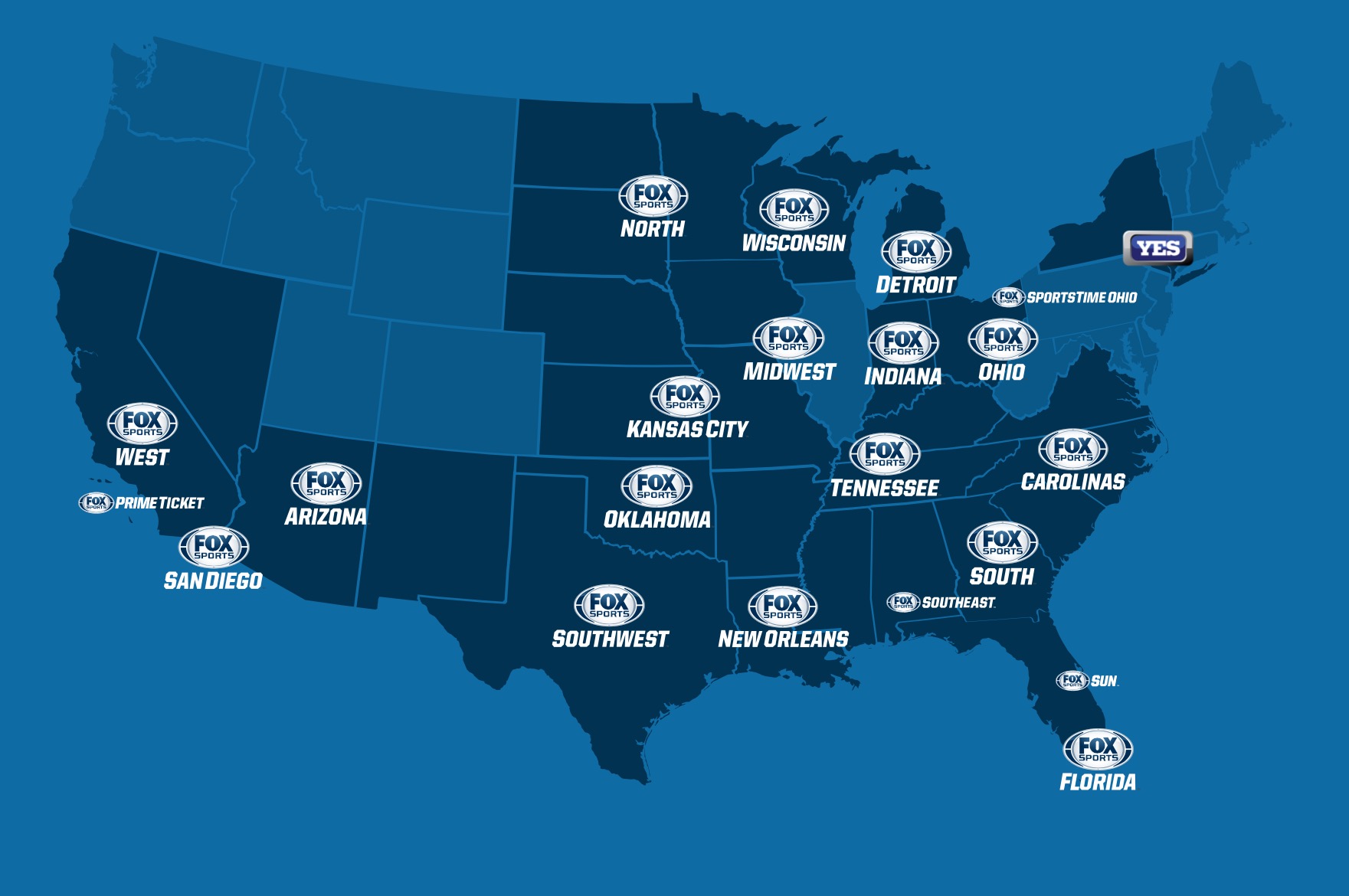

A few reasons for this. First, the locations across the country and the value of the product. Do the Cavaliers and Lakers reach the same amount of people? Do the Oklahoma City and the Minneapolis networks both have professional hockey, basketball, football, and baseball? It’s not a national network with a uniform price and uniform content. The more professional product you get and the closer you are to the main city where these teams play, the more it’ll cost you as a subscriber.

National networks? It’s all about carriage and consistency. Speed Channel had a flawless transition to Fox Sports 1 because only the content changed, not the carriage.

So why sell? It’s a great question, and usually comes down to money, and competition with the Worldwide Leader in Sports. But there are a few factors that add to it.

Long-term contracts with providers

When negotiating agreements, a question I rarely received from providers was “How long is your contract with the teams?” It was surprising to me. How had that not been a thought? What if the team decided to go in another direction? I’d be paying for a channel with no product on it. While most contract end dates with teams aren’t confidential information, it’s not the most known either. The deals with teams were done quietly.

This tells me that contracts are locked up for a while with the professional teams locally, with rate certainty and average increases for the next few years. ESPN can absorb and re-negotiate when the contracts are up, with a rate reset to follow.

National contracts for professional and collegiate product

It’s no secret that Disney/ESPN has the rights to the biggest conferences and sporting events. There are no major league deals up any time soon. The NBA just re-upped with ESPN/Disney/ABC and FOX bowed out.

Personnel needs

Bringing back up the NCTC, and the merger of the biggest providers, there isn’t a need for a robust amount of people to renew agreements. Most major networks have “teams” of people that work on each provider account, and those are locked up for numerous years. The independent providers are either going out of business or getting a “take it or leave it” kind of deal. The negotiation does not exist.

Cost

The biggest reason: cost. Sports may be a cash cow, but obviously FOX isn’t seeing the value anymore versus how much it costs to own and operate. The news cycle is next of kin and broadcast networks keep close behind, getting $1-$2 average sub fees from their owned and operated broadcast channels (Retransmission Consent) for over the air (FREE) networks.

What this means for ESPN

Leverage, revenue gains, and their much-anticipated streaming service they are developing. And a facelift. ESPN has had its fair share of criticism, but this last round of layoffs was strategic, to say the least. They will be able to tie carriage together, move product around, distribute ESPN3 product across the RSNs, and maintain their monopoly of sports rights.

Final Thoughts

Why keep FS1? Assuming the contracts they have are worth keeping until they run out, that move will be made eventually. There would be no reason to keep it. And what about RSN day to day business? It’s not ESPN’s forte. It will be interesting to see how they would run it.

What we do know is FOX wouldn’t have made this move without it being well thought through and planned. They were always trying to compete and succeeding in many ways. They invested so much in the RSN business and the entertainment side of FX, etc., which is wildly successful. To make this huge pivot, they have a well thought out strategy and this decision was not something decided quick, or easy.