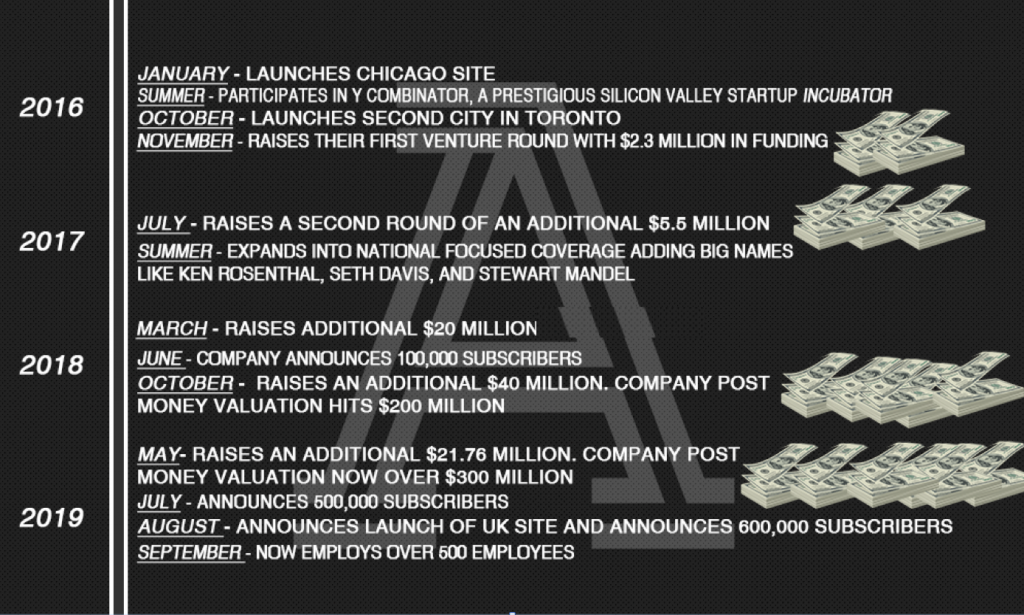

In June of 2018, The Athletic announced the site had hit 100,000 subscribers. This news came on the heels of the company raising a staggering $20 million round of venture capital funding, which I covered in detail. Then, The Athletic went dark for over 400 days and provided no updates on its subscriber growth.

During that blackout period (which The Athletic claims was because “we just like big round numbers” and that they are “focused on the forward looking goal of one million subs”), The Athletic raised a whopping $60 million, with the last $22 million being raised quietly with no official announcement this spring. This happened while The Athletic was spending money and gobbling up talent at a more aggressive and frenzied pace than a stray dog that found its way into a kitchen. The lack of subscriber updates and the amount of money going into the company made The Athletic the most talked subject in sports media, and speculation about the company’s future and finances ran wild throughout the industry.

How much money was The Athletic losing? Was the fundraising out of necessity to pay the bills, or was it just a growing war chest for a business that was taking off? Did the lack of an announcement on the most recent $22 million round of investment signal that the company was no longer dictating the terms to which they raised investments, or were the new investments now investor friendly deals? Had subscriber growth slowed down? Had the company attracted more than 200,000 subscribers? 300,000 subscribers? The lack of subscriber updates added to the heavy amount of skepticism focused on The Athletic, and many were adamant that the math didn’t work, The Athletic was hiring too many people and growing way too fast, and would (at some point) crash back to earth, which is a trend a lot of VC-backed startups seem to be encountering these days.

Someone who is good at the economy please help me pic.twitter.com/qWAgWa74bP

— Sam Sacks (@SamSacks) September 11, 2019

The Athletic finally flipped over their cards earlier this summer, announcing they had hit half a million subscribers. Barely a week later, on the heels of their UK launch, the company updated their subscriber count to 600,000, and stated they’d hit one million by the end of the year. The company’s skeptics scattered, and talk of a spectacular implosion all but went away.

With a good amount of trajectory we can map out now, the numbers suggest that The Athletic is not going to implode and disappear like many industry skeptics have predicted, both privately and publicly. There are certainly some scenarios where The Athletic could come back to earth and be a more mild success, but the reality is that a lot of the doomsday scenarios are, at this point, mostly out of play. The question now is how big can The Athletic get, and how will they get there?

The Athletic sets its sights on a billion dollar valuation, and perhaps an IPO

For many years, sports media pointed to Yahoo’s $100 million acquisition of Rivals in 2007 as the high point of a sports media exit. In 2012, Bleacher Report would be sold in the neighborhood of $200 million to Turner. While The Athletic has not been sold, their current valuation, based on how investors are valuing the company, has them north of $300 million already. In layman’s terms, investors are putting in money, believing that not only that the company is worth over $300 million now, but that the company still has a lot of upside to go before it is sold or goes public after an IPO.

In a pair of interviews I conducted with Athletic COO Adam Hansmann, The Athletic cofounder was not bashful in stating a billion dollar valuation was a realistic scenario for the company.

“We absolutely believe we can build a billion dollar business here. The basis of that belief is we believe there are tens of millions of avid sports fans globally that will become readers and listeners of our content.”

Sports media IPOs, for the most part, have been nonexistent over the last two decades, but Hansmann also seemed to think such an outcome was also realistic for the company.

“The New York Times, The Washington Post, the Wall Street Journal. Two of the three of those companies are publicly traded. We see differences in the models and the applications of what we are trying to do, but fundamentally those businesses focusing on news and politics have attracted enough subscribers and driven enough revenue over the years to be at that scale. We don’t see any reason to see why we can’t get there in sports.”

https://twitter.com/TheAuthletic/status/1172591955227791360

As for timing, Hansmann believes the company may need a full decade to hit full maturity.

“A business like this is capital intensive, but there is a payoff when you have a subscriber base and an “editorial moat” where we have the best talent covering every team and every sport. That’s a hard thing to build. It’s costly. But it’s something that will be very valuable in a decade. That’s honestly the time frame that we think in. It’s going to take a decade to build this business the way we want to build it.

How can The Athletic continue to grow at this pace?

There are a lot of factors you could point to as significant drivers of The Athletic’s growth up until now, but you’d be hard pressed to find anything more important than pure aggressiveness in the fields of hiring, expansion, and customer acquisition advertising programs. The aggressiveness in all of these areas has only been possible due to the nearly $100 million poured into the company by investors.

But where does the The Athletic go when the hyper growth experienced to date begins to plateau and the company is forced to look for new areas to grow, where the path to rapid growth seems less steep? With the UK launch reportedly having been a huge success out of the gate, Hansmann seems to be already mulling additional opportunities outside of the United States.

“I think we’re intrigued by the possibilities internationally beyond the UK. English speaking markets just naturally are a little more accessible for us, so that’s probably the key difference between the UK and the rest of Europe. I think we see a similar opportunity in other European countries.”

While The Athletic is eyeing the possibility of becoming a billion dollar company, another sports startup may have laid the blueprint for The Athletic to achieve such a milestone. A little under a decade ago, SB Nation was a sports startup clawing its way toward becoming a hundred million dollar company. For all intents and purposes, things were going well, but the pace of growth was plateauing for the network of sports blogs.

In 2011, SB Nation would launch a technology focused publication (The Verge), and the company would rebrand away from SB Nation (short for Sports Blog Nation) to Vox Media. Soon after, they would launch a general news and politics site (Vox.com), and in the years to come, Vox saw its valuation climb to over a billion dollars, bringing in hundreds of millions of dollars of new funding as the company continued to launch new verticals to diversify their offerings and expand their audience.

If SB Nation found the amount of fans who read about sports to be limited, it’s very possible that the amount of people who will pay for sports coverage could be significantly more limited. Hansmann didn’t discount the idea.

“It’s probably hard to think of a billion dollar media company out there just in one vertical, whether its sports or something else. I don’t hate the idea. So whether that’s us someday exploring other things or whether other publishers are going to take up the banner launching other subscription models, we are sort of bullish either way.”

Hansmann would go onto say their focus remains on sports in the short term, but the company had discussions with ESPN about possibly adding Nate Silver in early 2018, when ESPN wanted to offload Silver and his politics focused publication FiveThirtyEight. While Silver and FiveThirtyEight ended up staying in the Disney family and ABC News, The Athletic seems to have no rigid beliefs that they have to contain their business to just sports. Would they consider expanding into new content bundles? What verticals would they look to add, and when? Will other verticals be as easy to grow, given that verticals like politics, entertainment, and food often don’t lend themselves to local hires with large built in followings, which has been essential to The Athletic’s current growth recipe?

Areas of concern

If The Athletic does indeed hit a million subscribers by the end of the year, it becomes very plausible that the company will bring in $100 million of revenue in 2020. Such a revenue milestone would certainly validate the enthusiasm of investors in the company. However, even if The Athletic does hit these next batch of milestones, there are some things that could sidetrack the company’s path to a large exit, via either an IPO or an acquisition by a larger company.

One thing that isn’t talked about much is that The Athletic doesn’t seem to have one major national competitor. For decades, the recruiting coverage industry has seen multiple national networks competing against each other and splitting the market. At first it was just Rivals and Scout, before 24/7 came along and eventually merged with Scout. This competition stifled the growth and ambitions of each company as they fought for talent and customers. The Athletic has a massive head start on any national competitor, but it’s still plausible you could see a company like ESPN, or perhaps even DAZN, decide to roll out a similar offering, with both companies looking for new ways to attract subscribers to their subscription offerings. Additionally, as we’ve seen with Uber and Lyft, Bird and Lime, and White Claw and Truly, a secondary competitor often emerges and attracts funding when a new business idea seems to be gaining traction.

Another possibility would be some level of labor instability. Just this past summer, we saw employees at Vox Media walk off the job towards the tail end of a collective bargaining process for Vox’s newly formed union. The Ringer has just started that process, and while Barstool employees have never publicly discussed forming a union, it’s been a popular talking point on Twitter among those unaffiliated with the company. Hansmann seemed to think that discontent with the editorial staff, stemming from a unionization movement, was unlikely.

“We treat our people extremely well, as you can talk to any of them about in terms of compensation or having an ownership stake in the business in the form of stock options. Having benefits I would put up against any other digital media company bar none, including legacy media companies. I think we treat our people incredibly well. You are talking to me right now while my co-founder Alex is out on 12 week paternity leave, which we give all employees. I think on a basic level, not to sort of play dumb, but we treat our people really well. We ask a lot of them, but we give a lot back to them and I think that will continue to be the case as we grow.”

But what seems to be the most plausible threat continues to be the one that skeptics have pointed to since the company’s founding. With the company currently not profitable, and monthly expenses continuing to increase, it certainly is a possibility, if not an outcome that could happen within the next year. This has long been the outcome many have predicted: the company would sink into the sea and 500 employees, the majority of which would be editorial, would be shit out of luck.

While some within the industry will continue to predict a total implosion, there are three things that don’t make it seem all that realistic.

- Even if the company stubbornly continued to spend until it couldn’t get any additional investment or loans, many media companies or hedge funds would swoop in to buy The Athletic at a discounted price. The credit cards of a million or so subscribers renewing every month or year is a valuable commodity, and it is the company’s de facto insurance policy, which could bring a diverse group of potential buyers.

- With nearly $100 million of venture capital already in the company from a variety of different VC firms, any turbulence the company did encounter would likely just see those firms double down on their investment. VC firms would still see the value of the business, but would just look to take the majority of the remaining interest in the company for the lifeline and would then likely look to make management and strategic changes to stabilize the business.

- It’s not particularly hard to borrow money when you have recurring revenue collected automatically by credit cards. The Athletic could potentially buy themselves time by borrowing and then start downsizing their spending to a point where the company was profitable.

Essentially, one million subscribers and $100 million of annual revenue gives the company a significant amount of insurance for a rainy day that could come down the road. This is just too big of a business for it to cease to exist and for existing investors to simply walk away from.

Despite the signs that The Athletic is emerging as a healthy company that can stand on its own, there will continue to be skepticism about its future. The Silicon Valley ethos of speeding up when you see signs you should slow down all too often cripples companies that could have found their footing if they weren’t accelerating through one stop sign after another. But for every handful of these companies whose demise is partially aided by Silicon Valley’s grandeur, there is one successful company that surely could have not succeeded without Silicon Valley’s specific flavor of crazy.

In spite of the skepticism and the warning signs, The Athletic seems to be on the cusp of emerging as one of the latter. Where that road ultimately ends is unclear, but for now, it seems definitive that the most common prediction about the company is no longer a reality. This new reality is, at the very least, a positive development after a decade of decline for journalism.