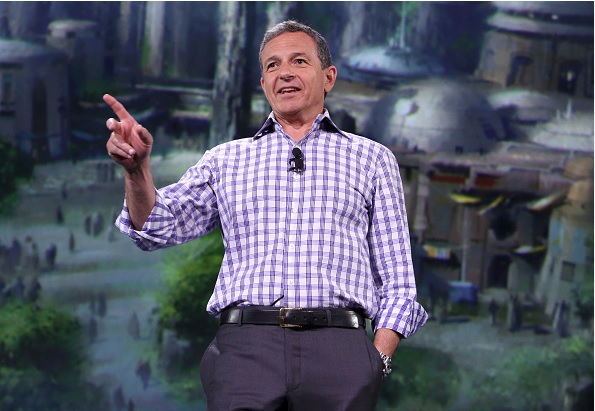

ESPN’s subscriber losses have played a substantial role in Disney’s stock price collapse, with analysts’ concerns over the future of the Worldwide Leader outweighing many of the company’s other successes, and now it appears that the company could find itself in some legal hot water over the timing of those subscriber loss revelations. Deadspin’s Tom Ley and Kevin Draper reported Wednesday that the high-powered Labaton Sucharow law firm, which has brought plenty of class-action lawsuits on behalf of defrauded investors, is now looking into how ESPN’s announcements of subscriber losses compare to public statements from Disney CEO Bob Iger (pictured above) and others:

On Nov. 25, 2015, Disney’s stock price was at $118.67 per share. That same day, Disney submitted its annual 10-K filing to the Securities and Exchange Commission, which revealed that the ESPN cable network—80 percent owned by Disney—had lost three million subscribers in the fiscal year that ended on Oct. 3. When the market reopened on Nov. 27, Disney’s stock went into a sustained free fall, reaching a low of $88.85 per share on Feb. 10. Currently, Disney’s stock price is sitting at $96.42 per share. ESPN is Disney’s greatest profit center, and the subscriber loss was enough to send Disney investors into a mild panic; it was also enough to get the Labaton Sucharow law firm thinking about a potential securities fraud suit.

Sources tell us that Labaton Sucharow has reached out to former ESPN employees in an attempt to gather information that could be used in a potential class-action suit against Disney. According to a source, the firm is particularly interested in any internal ESPN or Disney documents—emails, meeting notes, slideshow presentations—that could prove Disney knew the exact severity of the subscriber loss during the 2015 fiscal year, but chose not to reveal it to investors. The question at hand is if Disney executives knowingly misled investors by publicly expressing confidence in ESPN’s subscriber base while they were privately aware that a big drop in subscribers had occurred.

So, the big question is if comments from Iger (including “We feel bullish about ESPN and ESPN’s business”) before those subscriber losses came out (and it’s worth noting those are Nielsen estimates, not ESPN’s own in-house numbers, which they aren’t sharing but say are higher) rise to the level of “knowingly misleading investors.” Deadspin spoke to Michigan law professor Adam Pritchard, who said “If Disney executives knew ESPN had suffered a substantial loss of subscriptions in fiscal year 2015, they will need a credible explanation for why they didn’t reveal that loss to investors before the end of the year.” We’ll see if Labaton Sucharow actually launches a suit against ESPN and Disney, but if they do, those executives might need a good explanation for why they downplayed the losses before that year-end filing.

[Deadspin]

Comments are closed.