There were a couple of interesting developments to come out of the Bay Area late Tuesday. First, the San Jose Sharks have opted to not renew long term broadcaster Drew Remenda’s contract. Remenda’s unexpected departure from CSN California came as a surprise given his thirteen year history with the team and his status as a fan favorite.

While the Remenda story caught many hockey fans off-guard, a potentially even more noteworthy story broke hours later as Mark Purdy reports that the NHL is attempting to renegotiate the Sharks television deal with Comcast, one that has 14 years left on it. From the article:

“Simply put, the Sharks’ local television contract is not acceptable to them. They think it stinks. Stinks so bad, in fact, that it could affect the team’s long-term ability to stay in San Jose and the Bay Area.”

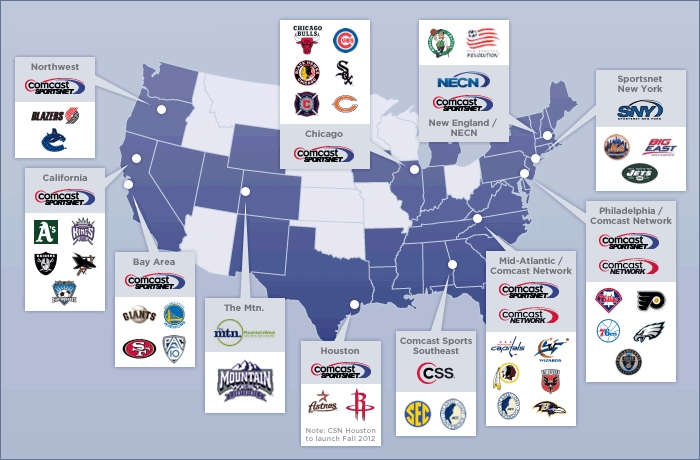

“How serious is the concern over the Sharks’ television deal? I have learned and confirmed that National Hockey League commissioner Gary Bettman has taken the extraordinary step of personally intervening in the matter. Bettman has contacted high-level honchos at Comcast corporate offices in Philadelphia to see if the Sharks’ local television deal can be reworked. Comcast is the parent company of Comcast Sportsnet Bay Area, which broadcasts Shark games. So far, the Bettman talks have not been fruitful.”

Before diving head first into this, some background…

The Sharks signed their deal in 2009 and per the article it pays them an average of $7 million a year. Again, that deal doesn’t end for another 14 seasons.

The top tier of local NHL television contracts seems to be north of $30 million per year. The Mercury article references teams in the Sharks punching class in terms of television market size and fan base size as having deals in the $20 million plus neighborhood, hence the Sharks “bad” deal is costing them around $13 million a year and the next 14 years would accrue to somewhere near $200 million as television rights continue to rise.

Woof that is a bad deal…….for the Sharks that is.

For Comcast, it’s one of many perfectly timed deals consummated in the 2008-2010 window where the economy stalled the growing sports television rights surge (hard to call it a bubble when it doesn’t seem likely to pop). Any team, conference, or league who signed a long term deal (long being let’s say anything going past 2020), has to absolutely be kicking themselves for doing so as the valuations on these television deals has climbed 50%-100% depending on the property in question. And that’s only how much they’ve gone up until now. Who knows just how much more they’ll continue to go up as teams, leagues, and conferences remain locked into these long term deals in the second half of this decade and into the next one where a lot of these deals lapse or will be renegotiated.

While there have been some high profile disasters of sports cable channels going belly up like CSN Houston and others potentially looming like SportsNet LA, thus far the only real “out” channels have had for bad deals they’ve swung has been bankruptcy court. But for teams? There hasn’t really been any move to make as they count the millions and millions of dollars they left on the table with no end in sight. The Giants, A’s, Warriors, and Sharks all fall into this bucket as teams who plain and simple entered into really bad long term deals that get worse every year.

Obviously these deals will effect their owner’s pocketbooks but the real interesting question is if and when it will become a significant detriment to their ability to compete. Every situation is different, but I couldn’t help but laugh at this SBJ article from over a year ago where they conducted a Q&A with A’s owner Lew Wolff.

“You look at the rest of the division, and there is a big gulf in TV revenue. Texas and the Angels just signed big deals with Fox. Seattle just did its big deal with DirecTV. Houston is trying to get its new RSN with Comcast established. It seems like you’re the outlier now.

WOLFF: I would disagree with that. I think we have been one of the first, not a mega-contract, but one of the first new contracts of this era. I think the Giants, too. I think our deal [about $45 million a year] is sort of in the middle of the contracts.

But if you look over the next decade, there are certainly going to be more clubs heading toward and exceeding nine figures annually.

WOLFF: We think we could get to that if we had a new ballpark. Plus, we have an out in our contract [with Comcast SportsNet] a few years down the road where we can reopen it [the option comes in 2023]. Time passes faster than you can imagine. So I think we’ll be OK in that area. We’re OK now, and it’s going to get better.”

I love the fact that Wolff points to an out “a few years down the road” and SBJ adds in parenthesis that’s really 10 years away, but it’s okay as “Time passes faster than you imagine.”

Braves ownership had a more honest take by saying in an article titled ‘Braves CEO says TV deal isn’t crippling‘,”We have a long-term, 20-year deal. It is what it is. It was a deal that we didn’t like when we saw it, when we inherited it. And we knew that in the performance of time, it would probably not be the deal that we would like to have in the marketplace to exploit.”

What SBJ was trying to get to the bottom when interviewing Wolff is how can you compete if you’ve shit the bed on your television contract. The Giants can endure it, although it probably gnaws at them more than the Zito contract did. The Sharks, Warriors, and A’s are a little more exposed without 81 home games with pricey tickets to help soften the blow. So with a decade of pain left for all parties involved, it looks like the Sharks may have found the magic door to get them out of hell that other teams may rush to try to fit through as well.

Combined with an expiring lease or a below average stadium or arena, bad television contracts now may destabilize a team to the point where they might have to flea the area. Or at least that’s what they’re selling the league and apparently in the Sharks scenario, it’s working.

The only leverage the Sharks can exert is the threat of leaving and I don’t think many would take that threat seriously. Purdy’s article points to Comcast maybe selling some equity of the channel to the Sharks mirroring similar arrangements Comcast has with NHL teams in addition the one they have with the Giants as one of the few viable solutions here.

If Bettman and the NHL work a miracle on behalf of the Sharks, this is certainly something to keep an eye on as there would be a line around the block of team owners looking for help to finagle out of their poorly timed and strategized deals. If the Sharks remain locked in, perhaps you’ll see lengths of television deals reverse course to avoid these type of lock-in deals. It might even be wise for the pro leagues to extend advisory and consulting services to teams as well given how significant these deals can be and the growing percentage of teams that have run into either distribution issues or revenue issues.

While there are a lot of questions surrounding this development, we now do have an answer to the question of what does it take to get a pro league commissioner to beg and grovel? In today’s day and age, it’s not a lockout or getting blacked out on DirecTV but rather just a bad television contract. If Bettman’s groveling succeeds, Adam Silver and Bud Selig’s replacement better get ready to start puckering up as well as this could become a big part of their high paying jobs going forward.

Comments are closed.