There’s been quite a bit of talk about the number of subscribers ESPN has lost so far this decade. Some are predicting a bleak future for the boys in Bristol. Others are suggesting that the cord cutting hype is just that, and the self-proclaimed “Worldwide Leader In Sports” will come out of this just fine.

What people need to do, however, is looking at the data. The numbers themselves are beginning to tell quite a story.

For example, here are ESPN’s subscriber numbers over the last four years, according to Nielsen:

- July 2011: 100.13 million homes

- July 2012: 98.9 million homes (-1.23 million)

- July 2013: 97.98 million homes (-0.92 million)

- July 2014: 96.17 million homes (-1.81 million)

- July 2015: 92.9 million homes (-3.27 million)

The losses over the last two years in particular show a pattern: the number of people dropping ESPN through cord cutting or cord shaving has been increasing at a rate of 45 to 50%, year over year. Cable’s increasing costs remain the biggest factor, and those costs continue to go up in spite of customer losses — in large part because cable networks and pay TV providers are jacking up prices faster than customers can flee. This Techdirt piece highlights how Cablevision has been able to get away with this so far:

At one time a cutting edge company that offered some of the fastest speeds at the best prices in the industry, over the last few years the company has resorted to winking and nodding at regional competitor Verizon every time it’s time to raise rates on TV and broadband services. Company chief James Dolan recently declared that offering promotional rates and trying to compete on price was a “dead end” for the company, and as a result, a recent SNL Kagan study showed how Cablevision customers paid some of the highest prices for cable anywhere.

The result? Cablevision lost 56,000 video, 23,000 broadband and 33,000 Internet voice subscribers last quarter, but saw a 3.7% jump in net revenue. So stock jocks are temporarily happy, but that’s not really a sustainable way to function long term — unless of course your long-term goal is to sell your company to Comcast.

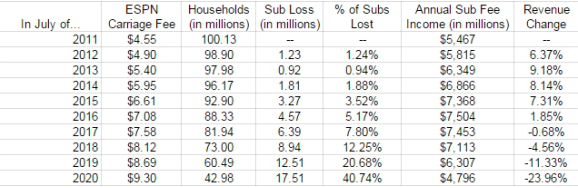

Likewise, ESPN’s carriage fee increases have outweighed their subscriber losses over the last four years, because ESPN’s carriage fee increases 6.5% annually. As the table shows below, the carriage fee increases have outweighed the losses.

Note that carriage fee income has still increased for ESPN every year since 2011. Note also that the growth of carriage fee revenue has decreased over the last two years. This is the only real sign on this table that the numbers are starting to drop.

With that in mind, let’s extrapolate some numbers through the end of the decade. Let’s presume that ESPN’s carriage fee continues to increase by 6.5% per year, but the number of subscribers dropping ESPN increases at a rate of 40% per year — a slightly lower rate than the last two years. Here’s how ESPN’s carriage fee income would look through the year 2020:

It’s almost impossible to fathom that ESPN would be in less than 50 million homes by decade’s end — until you recall that Digitalsmiths survey that found only 35.7% of consumers would keep ESPN in an a la carte cable lineup. In a future where streaming options increase as quickly as cable costs do, these numbers could become very real for ESPN — a bit too real, perhaps, given that the network’s NFL, NBA, and MLB TV deals alone will cost more than $4 billion per year by 2020. Add that to more than a billion dollars spent annually on college sports rights, and it’s clear that the boys in Bristol face real trouble in the long term.

ESPN can find ways to mitigate this. Perhaps they could take advantage of new over-the-top TV services — like Sling TV and Apple’s forthcoming TV offering — to regain some of that lost revenue. Perhaps they can find other sources of revenue through big game screening at theaters or other public venues. Buffalo Wild Wings stock performs well for a reason, and it ain’t the wings.

Or perhaps ESPN can start doing what so many other companies seem capable of doing: connecting with the people who actually want their product and giving them reasons to buy it. There must be 30 million people out there willing to throw down $19.95 a month for their sports fix. Thanks to the cable bundle, ESPN hasn’t had to look for those sports fans. Now might be a good time for them to start.

In the short term, ESPN will be just fine. The only signs of cash-flow trouble in the next year or two will be the departure of high-profile on-air personalities — Colin Cowherd is the latest to leave — and a few more games called by announcers in the “Bristol broom closet” rather than on location. If ESPN insists on tying its future to the cable bundle, though, we can expect to see a new “Worldwide Leader In Sports” sometime in the 2020s.

Dave Warner writes about sports and the cable industry at What You Pay For Sports. Follow Dave on Twitter at @whatupay4sports.

Comments are closed.