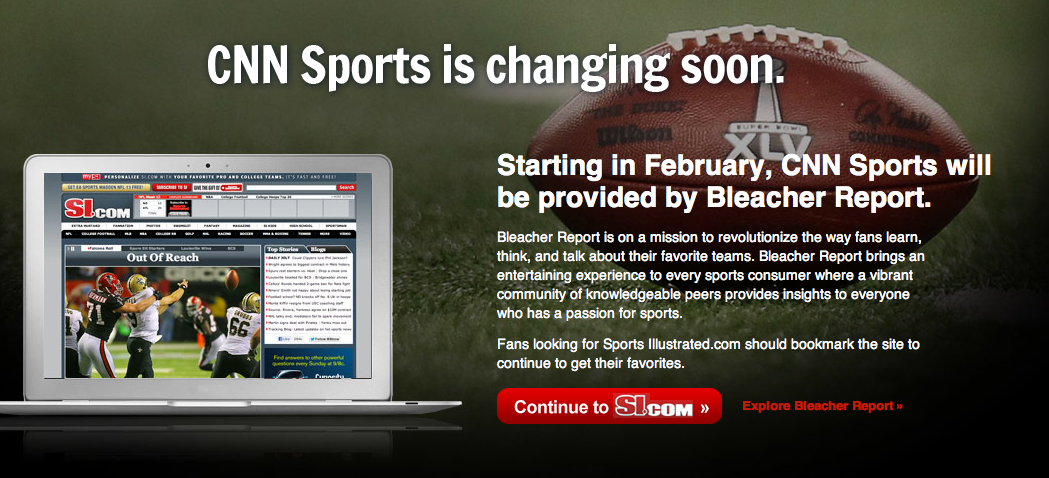

Last week, CNN revealed they were leaving behind their lengthy partnership with Sports Illustrated for a new relationship with Bleacher Report. The announcement was met with a multitude of passionate reactions ranging from excitement to outrage and disbelief to fascination. That CNN.com is moving in this direction come February should not be unexpected given Turner's healthy investment in Bleacher Report and desire to integrate the polarizing site across its numerous platforms. Nevertheless, it comes at the expense of several years of history working together with Sports Illustrated.

The significance of CNN switching just two letters from SI to BR can't be understated. It's a watershed moment in the continued evolution of the sports media and the online world. Here's a website founded in 2007, featuring a roster of mostly unpaid writers, replacing an outlet that printed its first issue in 1954 and still boasts one of the best sportswriting staffs in the country. A content factory that produces hundreds if not thousands of articles in a single day is now the chosen sporting vehicle for one of the most recognizable networks in the world while the premier weekly print magazine in sports is left looking for a new online partner. It's a stunning turn of events that may define the industry moving forward and will create a domino effect that may lead to even more shifts across sports media.

While Bleacher Report will surely enjoy the fruits of their new corporate backing through newfound visitors via CNN.com, Sports Illustrated is now on the market. Ever since it was announced that the short strategic partnership between Turner and Sports Illustrated was dissolving, SI had to know this day was coming. The acquisition of Bleacher Report by Turner only cemented this reality.

Over the course of the last year, the seeds were being sown at Sports Illustrated to brace themselves for the loss of CNN.com referral traffic. A significant portion of SI.com's will be affected as it's estimated from talking to several sources that 20% or more of SI's traffic came from CNN.com in most months. It's enough of a concern that one of SI.com's most successful brands, Jimmy Traina's Hot Clicks, has instructed readers from CNN.com on how to reach the page in the future. With the anticipated loss of CNN.com, SI has added new partnerships with National Football Post and Fansided to begin developing a new online strategy. More shuffles have taken place at the highest levels of the company with Paul Fichtenbaum and Chris Stone now running the show. Jim DeLorenzo was also hired in the last year to help the digital effort and the magazine has moved to synthesize their print and online efforts as have other Time properties.

While being shown the door by CNN may be a blow to SI's psyche, it also represents an opportunity. Sports Illustrated is now free to invest the resources that previously went to CNN.com in a new partnership. We asked Sports Illustrated about their plans for the future and where the magazine may head now that they're well and truly on the market. An SI spokesman replied, "The transition plan has been in place for nearly a year and we've been extraordinarily aggressive in developing new partnerships of all sizes and scope in the digital space. We're quite confident in where we stand today and going forward."

With high quality content and an iconic brand, many in the industry are already speculating what type of replacement deal SI can find to replace the CNN firehouse. For those thinking it would be some sense of poetic justice if Google were to partner with SI, that scenario is highly unlikely. Google typically aims to be content partner agnostic although many content players including Bleacher Report have crafted platform and publishing strategies to maximize promotion through the popular search engine.

Looking at the major portal players, MSN is paired up with Fox Sports, which includes a modified URL structure (http://msn.foxsports.com/). The smart money is that Fox will continue with that relationship given their aspirations to launch a national competitor to ESPN and the necessity to bring a bevy of allies and platforms into that battle.

The obvious partner would be AOL, who is about 2 years removed from entering into a deal with The Sporting News, which also includes a modified URL (http://aol.sportingnews.com/). The length of that deal remains unknown although many speculated it could be a 2 year deal. That timing could create an interesting couple weeks of musical chairs between news portals and original content creators.

In January 2011, Sports By Brooks reported AOL would receive around $5 million a year from Sporting News. Was that tidy sum an investment to kick start The Sporting News 's online presence which at the time was limited to 3 million readers a month, a fraction of the 10 monthly million audience AOL's FanHouse at the time of the deal? Or was the deal with AOL a last ditch effort for Sporting News to turn around its print magazine business by leveraging multiple platforms and larger scale editorial and advertising operations? On the heels of the announcement that Sporting News has ceased its print edition, it's probably already a stressful time for those employed by the Charlotte based content provider.

If AOL were to revisit its sports options, they'd certainly find a seller's market as SI, Sporting News, and potentially the likes of SB Nation would have interests in securing the AOL traffic firehouse. You have to keep in mind that both SB Nation and SI.com are run by executives who made their bones at AOL in its prime. With SB Nation's momentum and SI's pedigree and continued print presence, you would imagine that AOL would repoen the bidding if they had the ability.

Unfortunately, if Sporting News were to lose the AOL partnership, the company would be put in a tough place to continue forward without any significant print or organic online distribution of content. On the flip side, an AOL-SI deal could be very potent on both sides and is probably what many had in mind when AOL purchased Time Warner many years ago before AOL was spun out.

Two years back it was rumored that AOL fielded another offer "by a prominent sports blog network" that was thought to be SB Nation, but was never confirmed. SB Nation didn't have the cash to match the Sporting News offer at the time, but now you could argue the attractiveness of doing a deal like this has gone up on both sides of the table. SB Nation has certainly improved its editorial product in that time as well as its valuation.

AOL is looking for new revenue opportunities which include the acquisitions of content brands like Huffington Post and TechCrunch. Those content acquisitions were deemed controversial at the time, but have since become more accepted by business analysts as smart buys. If AOL wanted to make another 9 figure content buy, a portal deal with SB Nation could get them an insider's view of that business ahead of a formal acquisition process. From SB Nation's point of view, a deal with AOL in exchange for equity would grow traffic, increase revenue, and potentially get the company profitable as it looks to move away from sustaining its growth via venture capital investment.

While the SI/CNN breakup certainly makes a big splash, keep an eye on the ripples as Sports Illustrated, AOL, Sporting News, SB Nation, and many others could potentially be involved in this everchanging online sports media landscape.

Comments are closed.